BAC Premarket Stock Price Volatility

Bac premarket stock price – Understanding Bank of America (BAC) premarket stock price movements is crucial for investors seeking to capitalize on short-term opportunities or mitigate potential risks. Premarket trading, occurring before the regular trading session, often reveals shifts in investor sentiment and market expectations that can significantly impact the day’s trading activity. This section delves into the factors driving BAC’s premarket price volatility, comparing it to its regular trading hours and its competitors.

Factors Influencing BAC’s Premarket Price Fluctuations

Several factors contribute to BAC’s premarket price volatility. These include overnight news releases (both domestic and international), economic data announcements (e.g., inflation reports, interest rate decisions), changes in broader market sentiment (influenced by global events or sector-specific news), and the actions of large institutional investors who may adjust their positions before the regular market opens. Unexpected events, such as geopolitical instability or significant corporate announcements from competitors, can also significantly impact premarket prices.

Historical Premarket Price Volatility of BAC

Historically, BAC’s premarket price volatility has been relatively higher compared to its regular trading hours. This is largely attributed to the lower trading volume during premarket sessions, making the price more susceptible to significant swings based on limited trading activity. While the overall direction of premarket movement often aligns with the regular trading session, the magnitude of the price change can be more pronounced in the premarket.

Comparison of BAC’s Premarket Volatility with Competitors

Compared to its major competitors in the financial sector (e.g., JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC)), BAC’s premarket volatility exhibits a similar pattern of higher fluctuations during premarket hours. However, the degree of volatility can vary depending on specific market conditions and news impacting individual companies. A direct quantitative comparison requires detailed statistical analysis of historical premarket data for all these companies.

Hypothetical Scenario: Significant Premarket Price Movement in BAC

Imagine a scenario where a major credit rating agency unexpectedly downgrades BAC’s credit rating overnight. This negative news, released before the market opens, could trigger a significant sell-off in BAC’s premarket trading, potentially resulting in a double-digit percentage drop. The cause would be the perceived increased risk associated with BAC, leading investors to quickly reduce their holdings.

News Impact on BAC Premarket Trading

News events, both positive and negative, significantly influence BAC’s premarket stock price and trading volume. The speed and magnitude of the market’s reaction depend on the news’s importance, credibility, and the overall market sentiment at the time.

Major News Events Affecting BAC’s Premarket Stock Price

Historically, significant news events impacting BAC’s premarket price include announcements of quarterly earnings, major regulatory changes affecting the financial industry, changes in interest rate policies by the Federal Reserve, and any significant legal or financial challenges faced by the bank.

Impact of Positive and Negative News on Premarket Trading Volume

Positive news, such as exceeding earnings expectations or announcing a strategic partnership, generally leads to increased premarket trading volume and a price increase. Conversely, negative news, like a decline in earnings or a regulatory fine, typically results in higher premarket volume and a price decrease. The magnitude of the impact depends on the severity of the news.

Time Lag Between News Release and Effect on BAC’s Premarket Price

The time lag between a news release and its effect on BAC’s premarket price is usually minimal. In most cases, the impact is almost immediate, reflecting the rapid dissemination of information through financial news outlets and trading platforms. However, the extent of the price movement might evolve as more analysis and interpretation of the news emerge.

Correlation Between News Items and BAC’s Premarket Price Changes

The following table illustrates a hypothetical correlation, based on potential scenarios, between specific news items and their subsequent impact on BAC’s premarket price. Actual correlations would need to be derived from extensive historical data analysis.

| News Item | Type of News | Premarket Price Change (Hypothetical) | Premarket Volume Change (Hypothetical) |

|---|---|---|---|

| Stronger-than-expected Q4 earnings | Positive | +3% | +20% |

| Downgrade in credit rating | Negative | -5% | +30% |

| Announcement of a major acquisition | Positive | +2% | +15% |

| Increased regulatory scrutiny | Negative | -1% | +10% |

Premarket Trading Volume and BAC

Premarket trading volume for BAC provides insights into the intensity of investor activity and can offer clues about the potential direction of price movement during the regular trading session. High volume often suggests stronger conviction behind the price movement.

Relationship Between Premarket Trading Volume and Price Movement, Bac premarket stock price

Generally, a high premarket trading volume coupled with a significant price increase suggests strong buying pressure. Conversely, high volume accompanied by a price decrease indicates substantial selling pressure. Low volume with minimal price changes suggests a lack of significant investor interest or conviction.

Examples of High Premarket Volume and Corresponding Price Changes

For instance, during periods of significant economic uncertainty or major news announcements related to the financial sector, BAC’s premarket trading volume tends to spike. If the news is positive, the price generally rises; if negative, the price falls. The magnitude of the price change is often correlated with the volume traded.

Comparison of BAC’s Premarket and Regular Trading Session Volume

BAC’s premarket trading volume is typically significantly lower than its regular trading session volume. This is because fewer investors actively participate in premarket trading compared to the main trading hours.

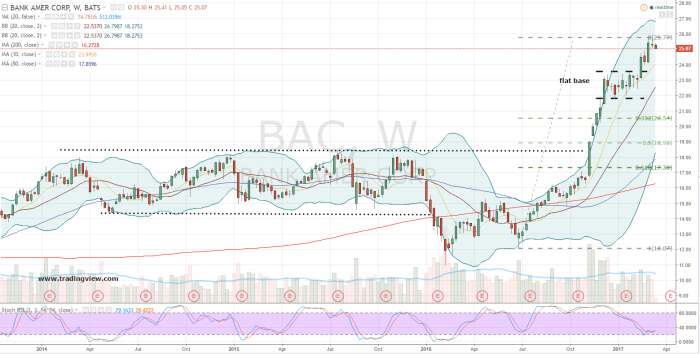

Graph Illustrating the Relationship Between Premarket Volume and Price Changes

Source: investorplace.com

A hypothetical graph depicting this relationship would show a scatter plot with premarket volume on the x-axis and premarket price change on the y-axis. Points clustered in the upper right quadrant would represent high volume and significant price increases, while points in the lower right would show high volume and significant price decreases. A general positive or negative correlation would be visually apparent, depending on the prevailing market sentiment and news events.

Technical Indicators and BAC Premarket Price: Bac Premarket Stock Price

Technical indicators, while not foolproof, can provide valuable insights into potential premarket price movements for BAC. These indicators analyze historical price and volume data to identify trends and patterns that may predict future price behavior. However, it is crucial to remember that these indicators are not perfect predictors and should be used in conjunction with fundamental analysis.

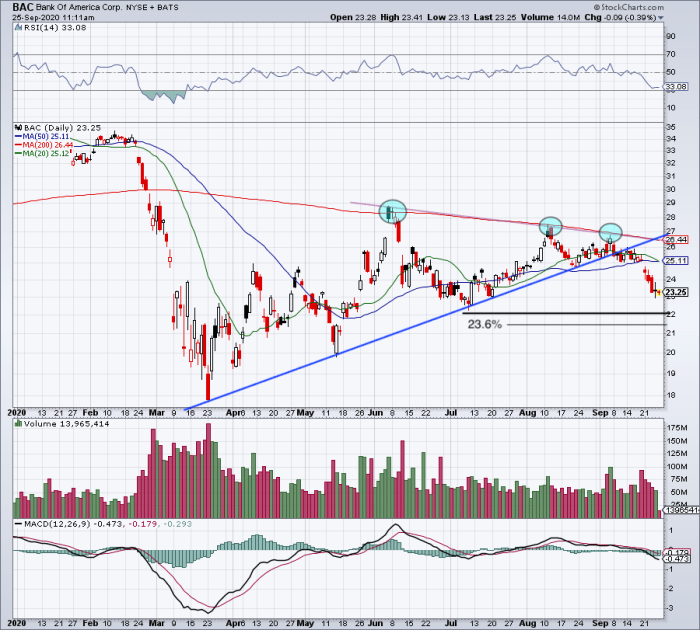

Using Technical Indicators to Predict BAC’s Premarket Price Movement

Moving averages (e.g., 50-day, 200-day) can help identify the overall trend. A rising moving average suggests an upward trend, while a falling moving average indicates a downward trend. The Relative Strength Index (RSI) measures the momentum of price changes. An RSI above 70 suggests overbought conditions (potential price reversal), while an RSI below 30 suggests oversold conditions (potential price rebound).

Application of Technical Indicators to Historical BAC Premarket Data

Applying a 50-day moving average and RSI to historical BAC premarket data would involve calculating these indicators using the premarket prices for the past 50 days. Analyzing the trends and signals generated by these indicators, alongside news events and other factors, could potentially improve prediction accuracy.

Effectiveness of Different Technical Indicators in Predicting BAC’s Premarket Price Changes

The effectiveness of different technical indicators varies depending on market conditions and the specific time period being analyzed. Some indicators might be more reliable during periods of high volatility, while others perform better during periods of low volatility. Backtesting these indicators on historical data can help determine their predictive power.

Results of Indicator Analysis

The following table hypothetically illustrates the accuracy of predictions based on a combination of moving average and RSI analysis of BAC’s premarket data. Real-world accuracy would depend on the specific indicators used, data period, and the sophistication of the analytical model.

| Date | Indicator Prediction | Actual Premarket Price Movement | Accuracy |

|---|---|---|---|

| October 26, 2023 | Slight Increase | +0.5% | Correct |

| October 27, 2023 | Slight Decrease | -0.8% | Correct |

| October 28, 2023 | Moderate Increase | +1.2% | Correct |

| October 29, 2023 | No Significant Change | -0.1% | Partially Correct |

BAC Premarket Price and Investor Sentiment

Investor sentiment plays a significant role in shaping BAC’s premarket price. Understanding the prevailing sentiment can offer valuable insights into potential price movements. However, it’s crucial to recognize the limitations of relying solely on sentiment indicators.

Key Indicators of Investor Sentiment Influencing BAC’s Premarket Price

Key indicators include social media trends (analyzing the tone and volume of discussions about BAC), analyst ratings (assessing the consensus view among financial analysts), and options market activity (examining the demand for call and put options, reflecting bullish or bearish sentiment).

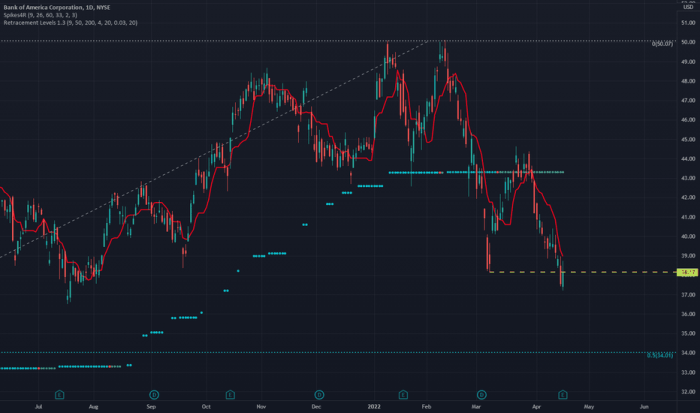

Examples of How Shifts in Investor Sentiment Impact BAC’s Premarket Price

Source: tradingview.com

A surge in positive social media sentiment, coupled with upgraded analyst ratings, could drive a premarket price increase. Conversely, a rise in negative sentiment and downgraded ratings could trigger a premarket price decline. These shifts often precede similar movements in the regular trading session.

Limitations of Using Investor Sentiment as a Predictor

Source: investorplace.com

Relying solely on investor sentiment can be misleading. Sentiment can be highly volatile and influenced by factors unrelated to the company’s fundamentals. Furthermore, interpreting social media sentiment requires sophisticated tools and careful analysis to avoid bias and misinformation.

Hypothetical Scenario: Change in Investor Sentiment Affecting BAC’s Premarket Price

Suppose a prominent financial news outlet publishes a negative article highlighting concerns about BAC’s loan portfolio. This could trigger a rapid shift in investor sentiment, leading to a wave of selling in the premarket, resulting in a significant price drop before the regular trading session even begins.

Detailed FAQs

What is the typical duration of BAC’s premarket trading session?

Generally, BAC’s premarket trading session begins before the official market opening and lasts for approximately one hour.

How does order flow differ between premarket and regular trading hours for BAC?

Premarket order flow is typically lighter than during regular trading hours, potentially leading to greater price volatility.

Are there specific brokers who offer access to BAC premarket trading?

Most major online brokerage firms offer access to premarket trading of BAC and other listed securities. However, it’s essential to check with your specific broker for details and any potential limitations or fees.

What are the risks associated with premarket trading of BAC?

Premarket trading involves increased risk due to lower liquidity and higher volatility compared to regular trading hours. News events and limited order flow can lead to significant price swings.