CCK Stock Price Analysis: A Comprehensive Overview

Cck stock price – This report provides a detailed analysis of CCK’s stock price, considering current market trends, influencing factors, company performance, investor sentiment, and potential future price movements. We will explore both the positive and negative aspects of investing in CCK stock, offering a balanced perspective for informed decision-making.

Current CCK Stock Price & Market Trends

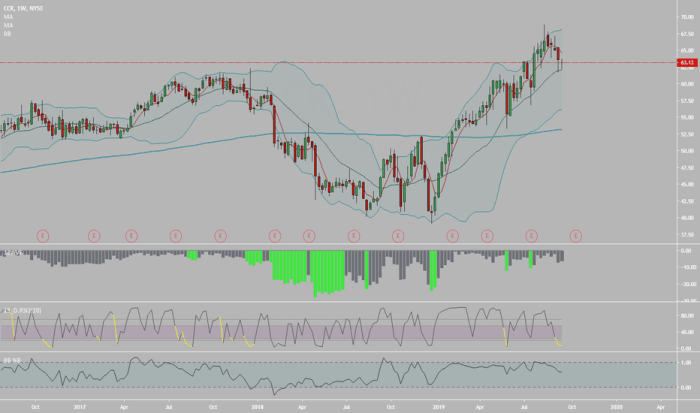

Source: tradingview.com

The current CCK stock price (as of [Insert Date]) is [Insert Current Price]. This represents a [Insert Percentage Change] change compared to the previous closing price. Over the past year, CCK’s stock has experienced significant volatility, with periods of both substantial gains and losses. For instance, the stock reached a high of [Insert High Price] on [Insert Date] and a low of [Insert Low Price] on [Insert Date].

These fluctuations are largely attributed to [Mention key market trends influencing the price, e.g., broader market trends, sector-specific performance, and company-specific news].

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| [Date 1] | [Open Price 1] | [High Price 1] | [Low Price 1] | [Close Price 1] | [Volume 1] |

| [Date 2] | [Open Price 2] | [High Price 2] | [Low Price 2] | [Close Price 2] | [Volume 2] |

| [Date 3] | [Open Price 3] | [High Price 3] | [Low Price 3] | [Close Price 3] | [Volume 3] |

| [Date 4] | [Open Price 4] | [High Price 4] | [Low Price 4] | [Close Price 4] | [Volume 4] |

| [Date 5] | [Open Price 5] | [High Price 5] | [Low Price 5] | [Close Price 5] | [Volume 5] |

Factors Affecting CCK Stock Price

Several factors contribute to the fluctuations in CCK’s stock price. These can be broadly categorized into economic factors, industry news, competitive landscape, and company-specific announcements.

Macroeconomic conditions, such as interest rate changes and inflation rates, significantly impact investor sentiment and overall market performance, consequently affecting CCK’s stock price. Industry-specific news, such as regulatory changes or technological advancements, can also create substantial price swings. CCK’s performance relative to its competitors within the same sector is another key factor. Finally, company-specific announcements, such as earnings reports and new product launches, often trigger immediate and sometimes significant price reactions.

CCK Company Performance & Financial Health

CCK’s recent financial performance reveals [Describe recent financial performance, including revenue growth, profitability, and debt levels. Use specific figures and data wherever possible]. The company operates under a [Describe CCK’s business model] model, leveraging [Mention key competitive advantages]. The management team, led by [Mention key management figures], has Artikeld a strategic vision focused on [Summarize CCK’s strategic vision].

| Ratio | Value |

|---|---|

| P/E Ratio | [Insert Value] |

| Debt-to-Equity Ratio | [Insert Value] |

| [Another relevant ratio] | [Insert Value] |

| [Another relevant ratio] | [Insert Value] |

Investor Sentiment & Analyst Opinions

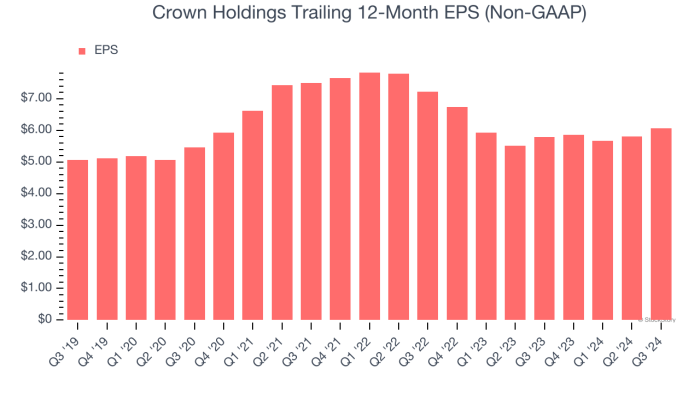

Source: barchart.com

Current investor sentiment towards CCK is [Describe investor sentiment, e.g., cautiously optimistic, bearish, bullish]. This is reflected in [Mention specific indicators of investor sentiment, e.g., trading volume, short interest, social media sentiment]. Recent analyst ratings have been [Summarize analyst ratings and price targets]. Recent news articles and reports suggest [Summarize key findings from recent news]. Investing in CCK presents both opportunities and risks, including [List potential risks and opportunities].

Potential Future Price Movements, Cck stock price

Predicting future stock prices is inherently challenging, but by analyzing current trends and potential catalysts, we can Artikel several possible scenarios for CCK’s stock price over the next six months. A bullish scenario, assuming strong market conditions and positive company news, could see the price rise to [Insert Price]. A neutral scenario, assuming market stability and moderate company performance, might see the price remain around its current level or fluctuate within a narrow range.

Tracking CCK stock price requires diligent monitoring of market trends. For comparative analysis, it’s helpful to consider other similar stocks; you might want to check the ball stock price today to see how it’s performing. Understanding the performance of related stocks, like BALL, can provide valuable context when assessing the current value and future potential of CCK.

A bearish scenario, considering negative market sentiment or unfavorable company news, could lead to a decline to [Insert Price]. These trajectories are illustrated below (descriptions only):

Bullish Trajectory: A steady upward trend, with minor corrections, reaching [Insert Price] within six months, driven by positive market sentiment and strong company performance.

Neutral Trajectory: A relatively flat trajectory with minor fluctuations around the current price, reflecting market uncertainty and moderate company performance.

Bearish Trajectory: A downward trend, potentially steep, reaching [Insert Price] within six months, driven by negative market sentiment or unfavorable company developments.

Comparing the potential returns of CCK with other investment options requires a detailed analysis of risk tolerance and investment goals. For instance, investing in [Example investment option] may offer lower risk but potentially lower returns compared to CCK, while investing in [Another example investment option] could offer higher risk and higher potential returns.

Question & Answer Hub: Cck Stock Price

What are the major risks associated with investing in CCK stock?

Investing in any stock carries inherent risks, including market volatility, potential for decreased profitability, and unforeseen negative events affecting the company. Thorough due diligence is crucial.

Where can I find real-time CCK stock price updates?

Real-time CCK stock price updates are typically available through major financial websites and brokerage platforms. Check reputable sources for accurate information.

How does CCK compare to its competitors?

A comparative analysis of CCK’s performance against its competitors requires a detailed examination of key metrics, including market share, profitability, and growth rates. This analysis will vary based on the specific competitors being considered.

What is CCK’s dividend policy?

Information regarding CCK’s dividend policy, if any, can be found in their investor relations materials or financial reports. This information is crucial for investors seeking income from their investments.