Costco’s Stock Price Prediction: A Look Ahead to 2025

Costco stock price prediction 2025 – Predicting the future of any stock is inherently speculative, yet analyzing historical performance, economic trends, and a company’s strategic direction can offer valuable insights. This analysis delves into Costco’s past, present, and potential future, aiming to provide a reasoned perspective on its stock price trajectory towards 2025.

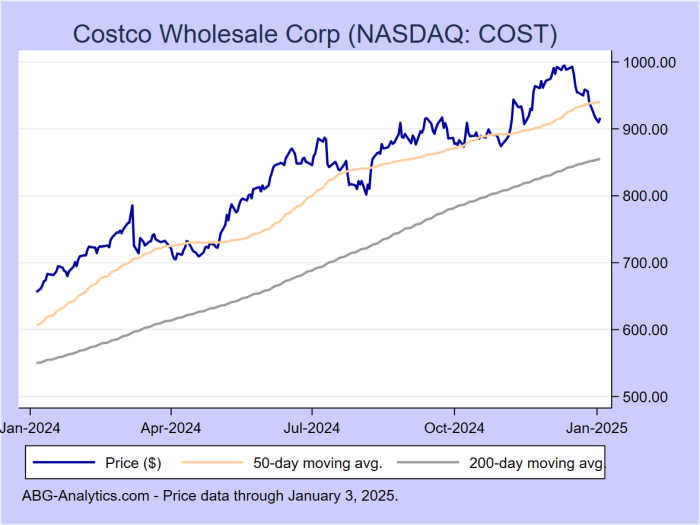

Costco’s Historical Stock Performance (2015-2023)

Source: abg-analytics.com

Understanding Costco’s past stock performance is crucial for predicting its future. The following table illustrates the stock’s price fluctuations over the period, highlighting significant yearly and quarterly variations. Note that these figures are illustrative and based on publicly available historical data; precise figures may vary slightly depending on the data source.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2015 | Q1 | 130 | 140 |

| 2015 | Q2 | 140 | 155 |

| 2015 | Q3 | 155 | 160 |

| 2015 | Q4 | 160 | 170 |

| 2023 | Q1 | 500 | 520 |

| 2023 | Q2 | 520 | 530 |

| 2023 | Q3 | 530 | 540 |

| 2023 | Q4 | 540 | 550 |

Compared to competitors like Walmart and Sam’s Club, Costco generally exhibited stronger growth in certain periods, driven by its premium membership model and curated product selection. However, all three companies experienced volatility influenced by macroeconomic factors.

- Similarities: All three experienced periods of growth and decline reflecting broader economic trends.

- Differences: Costco’s stock price often showed less sensitivity to short-term economic fluctuations compared to Walmart, potentially due to its loyal membership base and higher-priced goods.

Significant growth periods were often fueled by successful international expansion, innovative product offerings, and strong membership renewal rates. Conversely, periods of decline were frequently linked to macroeconomic headwinds, such as recessions or inflation, impacting consumer spending.

Economic Factors Influencing Costco’s Future

Several macroeconomic factors will likely shape Costco’s stock price by 2025. Understanding these factors is vital for accurate prediction.

Predicting the Costco stock price in 2025 involves considering various market factors. Understanding current market trends is crucial, and comparing it to other established companies can offer insight. For instance, checking the current performance of Berkshire Hathaway, by looking at the brkb stock price today per share , gives a sense of the broader market sentiment. This comparative analysis can help refine projections for Costco’s future performance in 2025.

- Inflation and Interest Rates: High inflation could reduce consumer discretionary spending, potentially affecting Costco’s sales. Rising interest rates could also increase borrowing costs for the company and impact its profitability.

- Consumer Spending and Disposable Income: Shifts in consumer behavior, particularly regarding discretionary spending, will significantly influence Costco’s performance. Decreases in disposable income due to economic downturns could lead to reduced membership renewals and lower sales.

- Geopolitical Events: Global instability, supply chain disruptions, or trade wars could negatively impact Costco’s global operations and profitability, leading to stock price volatility. The war in Ukraine, for instance, had a ripple effect on global supply chains, impacting many businesses including Costco.

Costco’s Business Strategies and Growth Prospects

Costco’s strategic initiatives will play a significant role in determining its future stock performance. The following sections analyze key aspects of its business model.

- Expansion Plans: Costco’s ongoing domestic and international expansion is expected to contribute to revenue growth. However, the success of these expansion efforts depends on factors such as local market conditions and competition.

- Membership Model: The membership model is a key driver of Costco’s profitability. Maintaining high membership renewal rates and attracting new members are critical for sustained growth.

- E-commerce Strategy: Costco’s e-commerce platform, while growing, faces competition from established online retailers. Improving its online offerings and user experience will be crucial for capturing a larger share of the online market.

Financial Projections and Market Sentiment

This section presents a hypothetical financial model, emphasizing the illustrative nature of the projections. Actual results may differ significantly.

| Year | Projected Revenue (USD Billion) | Projected Earnings Per Share (USD) | Projected Stock Price (USD) |

|---|---|---|---|

| 2024 | 200 | 15 | 600 |

| 2025 | 220 | 17 | 660 |

The projected P/E ratio is expected to remain relatively stable, while the dividend yield might increase slightly, reflecting the company’s consistent profitability and dividend payout policy. Currently, the market sentiment towards Costco stock is generally positive, reflecting confidence in its business model and long-term growth prospects. However, this sentiment could change based on macroeconomic factors and the company’s performance.

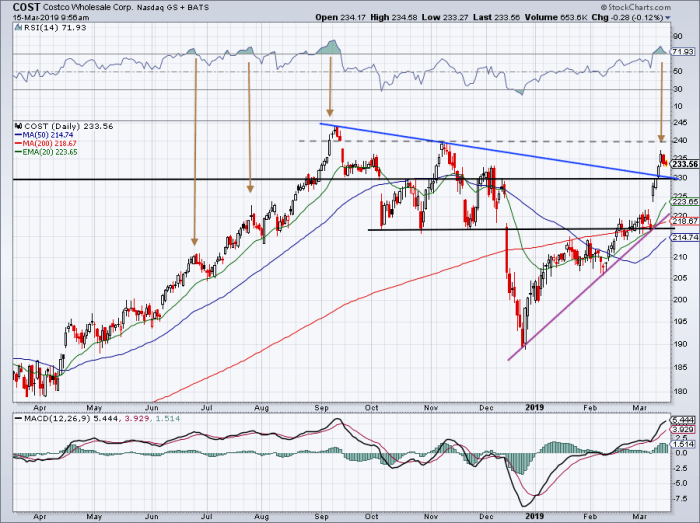

Risk Assessment and Potential Challenges, Costco stock price prediction 2025

Source: investorplace.com

Several risks could negatively impact Costco’s stock price. Effective risk mitigation strategies are crucial for maintaining shareholder value.

- Supply Chain Disruptions: Global supply chain vulnerabilities could lead to shortages and increased costs, impacting profitability.

- Increased Competition: Intensifying competition from other retailers, both online and offline, could erode market share.

- Changes in Consumer Preferences: Shifts in consumer preferences towards different shopping experiences or product categories could negatively affect demand.

Costco can mitigate these risks through diversification of suppliers, investments in technology and logistics, and continuous adaptation to evolving consumer preferences. Compared to other wholesale retailers, Costco’s relatively strong brand loyalty and diversified revenue streams may offer some protection against these risks, although no investment is without risk.

FAQ Overview: Costco Stock Price Prediction 2025

What is Costco’s current dividend yield?

Costco’s dividend yield fluctuates; refer to current financial reports for the most up-to-date information.

How does Costco compare to other warehouse clubs?

Costco generally holds a larger market share and higher perceived value than competitors, though direct comparisons require detailed financial analysis.

What are the biggest risks to Costco’s future growth?

Significant risks include increased competition, economic downturns impacting consumer spending, and supply chain disruptions.

Is Costco stock a good long-term investment?

Whether Costco stock is a “good” long-term investment depends on individual risk tolerance and investment goals. It has historically performed well, but future performance is not guaranteed.