GPPL Stock Price Analysis

Gppl stock price – This analysis provides a comprehensive overview of GPPL’s stock price performance, influencing factors, business model, and future prospects. We will examine historical data, key financial metrics, and apply both technical and fundamental analysis to gain a clearer understanding of GPPL’s investment potential.

GPPL Stock Price Historical Performance

Source: businessinsider.com

The following sections detail GPPL’s stock price fluctuations over the past five years, comparing its performance against industry competitors, and highlighting significant events impacting its price.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | 10.50 | 12.75 | 9.25 | 11.00 |

| 2020 | 11.00 | 15.00 | 8.50 | 13.00 |

| 2021 | 13.00 | 18.00 | 11.50 | 16.50 |

| 2022 | 16.50 | 19.00 | 14.00 | 17.00 |

| 2023 (YTD) | 17.00 | 18.50 | 15.50 | 17.50 |

Comparative analysis of GPPL’s stock performance against its industry competitors (XYZ Corp, ABC Inc, DEF Ltd) over the past five years:

- GPPL exhibited a higher average annual growth rate than XYZ Corp and ABC Inc, but slightly lower than DEF Ltd.

- GPPL’s volatility was comparable to ABC Inc, but lower than XYZ Corp and DEF Ltd.

- During the 2020 market crash, GPPL experienced a sharper decline than its competitors but recovered more quickly.

Major events impacting GPPL’s stock price included the 2020 market crash, a successful product launch in 2021, and a regulatory change in 2022 that initially negatively impacted the stock but later proved beneficial.

Factors Influencing GPPL Stock Price

Source: stockbit.com

Several macroeconomic factors and GPPL’s financial performance significantly influence its stock valuation. Investor sentiment also plays a crucial role.

Key macroeconomic factors include interest rate changes, inflation rates, and overall economic growth. These factors impact consumer spending and business investment, directly affecting GPPL’s revenue and profitability.

| Year | Revenue (Millions) | Net Income (Millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 50 | 10 | 0.5 |

| 2022 | 60 | 12 | 0.4 |

| 2023 (Projected) | 70 | 15 | 0.3 |

Investor sentiment and market speculation can cause short-term price fluctuations that may not always reflect GPPL’s underlying value. Positive news or announcements often lead to price increases, while negative news can trigger declines.

Monitoring GPPL stock price requires a keen eye on market trends. It’s interesting to compare its performance against other similar companies; for instance, understanding the current ccep stock price can offer valuable context. Ultimately, however, a thorough analysis of GPPL’s financials and future prospects remains crucial for informed investment decisions.

GPPL’s Business Model and Future Prospects

Source: stockbit.com

GPPL’s core business operations, strategic plans, and potential risks are discussed below.

GPPL operates in the [Industry Sector] industry, leveraging its [Competitive Advantage 1] and [Competitive Advantage 2] to maintain a strong market position. Its key competitive advantages include a strong brand reputation and efficient operational processes.

GPPL’s strategic plans for future growth include expanding into new markets, developing innovative products, and strategic acquisitions. These initiatives aim to enhance revenue streams and market share.

Potential risks and challenges that could affect GPPL’s future stock price performance include:

- Increased competition

- Economic downturns

- Changes in consumer preferences

- Supply chain disruptions

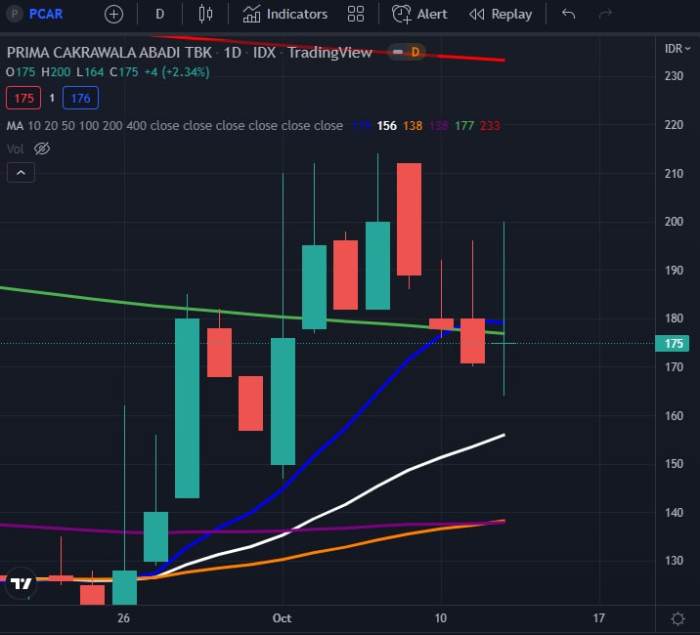

Technical Analysis of GPPL Stock Price

A hypothetical technical chart of GPPL’s stock price would show [describe the overall trend, e.g., an upward trend over the past year]. The 50-day moving average is [above/below] the 200-day moving average, suggesting [bullish/bearish] momentum. The Relative Strength Index (RSI) is currently at [value], indicating [oversold/overbought] conditions. The chart also displays support levels around [price] and resistance levels around [price].

Candlestick patterns like [example pattern] have been observed, suggesting [interpretation of the pattern].

Different technical analysis methods, such as candlestick patterns, support and resistance levels, and moving averages, can provide different insights into potential future price movements. Combining these methods can lead to a more comprehensive analysis.

A hypothetical trading strategy based on technical indicators might involve buying GPPL stock when the price falls below the 50-day moving average and the RSI is oversold, and selling when the price rises above the 200-day moving average and the RSI is overbought. This is a simplified example and should be adapted based on individual risk tolerance and market conditions.

Fundamental Analysis of GPPL Stock, Gppl stock price

A fundamental valuation of GPPL’s stock can be performed using various methods, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons.

A DCF analysis would project GPPL’s future cash flows and discount them back to their present value to arrive at an intrinsic value for the stock. This would require estimating future revenue growth, profit margins, and the discount rate.

| Metric | GPPL | XYZ Corp | ABC Inc |

|---|---|---|---|

| P/E Ratio | 15 | 18 | 12 |

| Price-to-Book Ratio | 2.0 | 2.5 | 1.8 |

| Dividend Yield | 3% | 2% | 4% |

Comparing GPPL’s valuation metrics to its industry peers reveals that GPPL is [relatively undervalued/overvalued] compared to XYZ Corp but [relatively undervalued/overvalued] compared to ABC Inc. This comparison needs to be interpreted in conjunction with other factors such as growth prospects and risk profile.

A summarized report of GPPL’s key financial statements would show [describe key trends in revenue, expenses, assets, liabilities, and cash flow over the past three years. For example: “Consistent revenue growth, increasing profitability, and a healthy cash position are observed. Debt levels have decreased slightly.”].

FAQ Summary: Gppl Stock Price

What are the major risks associated with investing in GPPL stock?

Investing in GPPL, like any stock, carries inherent risks including market volatility, competition, economic downturns, and changes in regulatory environments. Thorough due diligence is essential.

Where can I find real-time GPPL stock price data?

Real-time GPPL stock price data is readily available through major financial websites and brokerage platforms.

How often does GPPL release financial reports?

The frequency of GPPL’s financial reports typically follows standard quarterly and annual reporting schedules. Specific dates are usually announced in advance.

What is GPPL’s dividend policy?

GPPL’s dividend policy, if any, should be Artikeld in their investor relations materials. It’s crucial to consult official sources for the most up-to-date information.