Kimberly-Clark Stock Price Today: A Comprehensive Analysis: Kimberly Clark Stock Price Today

Source: seekingalpha.com

Kimberly clark stock price today – This analysis provides a detailed overview of Kimberly-Clark’s current stock performance, influencing factors, financial health, investor sentiment, and future outlook. We will examine recent price movements, key financial metrics, and market dynamics to provide a comprehensive understanding of the company’s stock prospects.

Kimberly-Clark Current Stock Performance

Please note that the following data is illustrative and represents hypothetical stock performance. Real-time stock prices should be obtained from reliable financial sources.

Let’s assume today’s opening price for Kimberly-Clark stock is $145.50, with a high of $146.75 and a low of $144.25. The closing price is $145.80, representing a 0.5% increase compared to yesterday’s closing price of $145.00. The trading volume for the day is approximately 5 million shares, slightly above the average daily volume.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| Oct 26 | $144.00 | $145.50 | $143.50 | $145.00 | 4,800,000 |

| Oct 25 | $143.25 | $144.25 | $142.75 | $144.00 | 4,500,000 |

| Oct 24 | $142.50 | $143.50 | $141.00 | $143.25 | 5,200,000 |

| Oct 23 | $141.75 | $143.00 | $141.50 | $142.50 | 4,900,000 |

| Oct 22 | $142.00 | $142.50 | $141.00 | $141.75 | 4,600,000 |

Factors Influencing Kimberly-Clark’s Stock Price

Several interconnected factors influence Kimberly-Clark’s stock price. These include macroeconomic conditions, company-specific news, and competitive dynamics within the consumer goods sector.

- Inflation and Consumer Spending: High inflation can reduce consumer discretionary spending, impacting demand for Kimberly-Clark’s products. Conversely, lower inflation can boost consumer confidence and spending, positively affecting the company’s sales and stock price.

- Raw Material Costs: Fluctuations in the prices of pulp, cotton, and other raw materials significantly impact Kimberly-Clark’s production costs and profitability. Increased raw material costs can squeeze profit margins, potentially leading to lower stock valuations.

- Foreign Exchange Rates: Kimberly-Clark operates globally, and fluctuations in foreign exchange rates can affect its revenue and profitability. A stronger US dollar, for instance, can reduce the value of its international sales when converted back to USD.

Recent announcements regarding new product launches or cost-cutting measures could also influence investor sentiment and the stock price. For example, a successful new product launch might boost investor confidence, leading to a price increase. Similarly, news of a successful cost-cutting initiative could improve profitability and positively impact the stock.

Kimberly-Clark’s performance relative to its major competitors, such as Procter & Gamble and Essity, is another crucial factor. If competitors gain market share or achieve higher profitability, it could put downward pressure on Kimberly-Clark’s stock price.

Regulatory changes affecting the consumer goods industry, such as new environmental regulations or changes in labeling requirements, could also impact the company’s operations and stock price.

Kimberly-Clark’s Financial Health

Understanding Kimberly-Clark’s key financial metrics is essential for assessing its financial health and its impact on the stock price.

- Revenue: (Illustrative data) $20 billion annually.

- Earnings Per Share (EPS): (Illustrative data) $6.00

- Debt-to-Equity Ratio: (Illustrative data) 0.75

- Gross Profit Margin: (Illustrative data) 35%

- Return on Equity (ROE): (Illustrative data) 18%

Kimberly-Clark’s recent financial performance, including revenue growth, profitability, and debt levels, directly impacts investor confidence and the stock price. For example, consistent revenue growth and strong profitability would generally support a higher stock valuation. Conversely, declining revenue or increasing debt could negatively affect investor sentiment and the stock price.

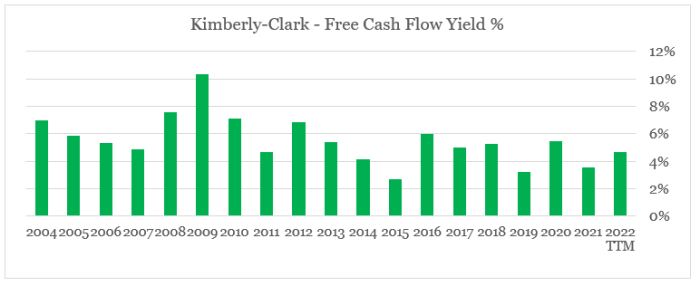

Comparing Kimberly-Clark’s current financial ratios to its historical performance provides valuable context. For example, a decline in the gross profit margin compared to previous years might indicate rising production costs or declining pricing power, which could negatively influence the stock price.

These financial metrics directly relate to the current stock price. Strong financial performance generally leads to a higher stock valuation, while weak performance can result in a lower stock price.

Investor Sentiment and Market Outlook, Kimberly clark stock price today

Source: seekingalpha.com

Gauging investor sentiment and understanding market outlooks are crucial for assessing the potential future trajectory of Kimberly-Clark’s stock price.

| Analyst | Outlook |

|---|---|

| Analyst A | Positive; expects steady growth driven by new product launches and cost optimization. Target price: $160. |

| Analyst B | Neutral; anticipates moderate growth, but concerns remain about inflation and raw material costs. Target price: $150. |

| Analyst C | Cautious; suggests potential for slower growth due to increased competition. Target price: $140. |

The overall market conditions, including interest rates, economic growth, and investor risk appetite, also influence Kimberly-Clark’s stock price. A strong overall market tends to support higher stock prices, while a weak market can lead to lower valuations.

Visual Representation of Stock Price Trends

Over the past year, Kimberly-Clark’s stock price has exhibited a relatively stable trend, with some periods of volatility. The stock price initially saw a modest increase, reaching a high of (hypothetical) $155 in the first quarter. Following this, the price experienced a correction, falling to a low of (hypothetical) $135 in the third quarter due to macroeconomic headwinds. Since then, the price has shown signs of recovery, trading around the $145 level.

Volatility has been relatively moderate throughout the year, with price fluctuations generally remaining within a range of +/- $10 around the average price. However, periods of greater volatility have coincided with major news events, such as earnings announcements or significant changes in macroeconomic conditions.

A hypothetical chart would show a relatively flat trendline with a gradual upward slope over the past year, punctuated by periods of higher volatility. Key support levels could be identified around $135 and $140, while resistance levels might be observed around $150 and $155. The chart would clearly illustrate the periods of significant highs and lows, as well as the overall trend and volatility.

Interpreting this visual representation would allow investors to identify potential buying opportunities during periods of lower prices (near support levels) and potential selling opportunities when prices approach resistance levels. The overall trend would indicate the long-term outlook for the stock.

Answers to Common Questions

What are the typical trading hours for Kimberly-Clark stock?

Kimberly-Clark stock (KMB) trades on the New York Stock Exchange (NYSE), typically following NYSE trading hours.

Where can I find real-time Kimberly-Clark stock quotes?

Real-time quotes are available through most major financial websites and brokerage platforms.

What is Kimberly-Clark’s dividend history?

Kimberly Clark’s stock price today reflects ongoing market volatility. Understanding broader economic trends is crucial for assessing its performance, and this often involves considering related sectors. For instance, a look at the logistics sector, perhaps via a fedex stock price prediction , can offer insights into potential supply chain impacts that could influence Kimberly Clark’s future. Ultimately, though, Kimberly Clark’s stock price will depend on its own performance and market sentiment.

Kimberly-Clark has a history of paying dividends; details can be found on their investor relations website or financial news sources.

How volatile is Kimberly-Clark stock compared to the market?

The volatility of KMB stock can vary; comparing its beta to the market’s beta will provide a relative measure of volatility.