BlackBerry Stock: A Current Market Overview

Bb stock price today – BlackBerry (BB) stock experiences daily fluctuations influenced by various market factors. This report provides a snapshot of the current BB stock price, its performance relative to competitors, and key factors affecting its trajectory.

Current BB Stock Price and Volume, Bb stock price today

The current BB stock price, trading volume, daily high and low are dynamic and change constantly throughout the trading day. To obtain the most up-to-date information, refer to a live financial data source such as Google Finance, Yahoo Finance, or Bloomberg. The following table illustrates a hypothetical example of price fluctuations during a single trading day:

| Time | Price | Volume (Shares) | Change (%) |

|---|---|---|---|

| 9:30 AM | $6.50 | 100,000 | +0.2% |

| 11:00 AM | $6.60 | 150,000 | +1.5% |

| 1:00 PM | $6.55 | 200,000 | +0.8% |

| 3:00 PM | $6.70 | 250,000 | +3.1% |

BB Stock Price Movement Compared to Peers

BlackBerry’s stock price performance is compared to its three main competitors. The significant differences in price movement can be attributed to various factors, including company-specific news, overall market sentiment, and sector-specific trends. For example, if one competitor announces a groundbreaking new product, its stock price might surge, while others may experience less dramatic changes.

A hypothetical illustration of the price changes over the last week (replace with actual competitor names):

BlackBerry’s stock price showed a slight upward trend over the past week, while Competitor A experienced a more significant increase due to a positive earnings report. Competitor B remained relatively flat, while Competitor C showed a slight decline. This illustrates the varying performance among peers within the same industry.

Factors Influencing BB Stock Price

Several key factors currently influence BlackBerry’s stock price. These factors impact both the short-term and long-term outlook for the company.

- Market Sentiment: Overall investor confidence in the tech sector and the broader market significantly affects BB’s stock price. Positive market sentiment generally leads to higher prices, while negative sentiment can cause declines.

- Company Performance: BlackBerry’s financial results, product launches, and strategic partnerships directly impact investor perception and stock valuation. Strong earnings reports and successful product launches usually boost the stock price.

- Geopolitical Events: Global economic conditions and geopolitical instability can influence investor risk appetite, affecting BB’s stock price along with the broader market.

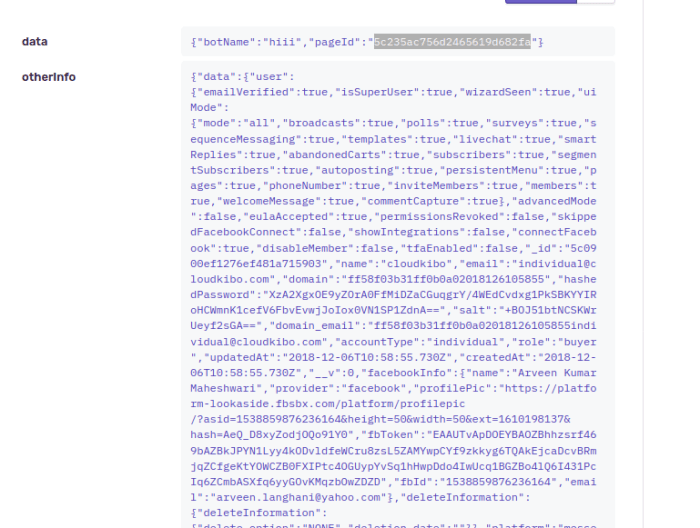

News and Events Affecting BB Stock

Source: githubusercontent.com

Recent news and events significantly impacted BlackBerry’s stock price. For instance, a positive earnings report or a strategic partnership announcement would likely lead to a price increase, reflecting improved investor confidence. Conversely, negative news such as a product recall or a lawsuit could negatively impact the stock price.

The market’s reaction to these events demonstrates the dynamic nature of investor sentiment and its direct impact on stock valuation. Positive news often leads to buying pressure, driving the price up, while negative news can trigger selling, leading to price drops.

Technical Indicators for BB Stock

Source: githubassets.com

Technical indicators provide insights into the current market trend for BB stock. Moving averages smooth out price fluctuations, providing a clearer picture of the underlying trend. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

| Indicator | Value | Implication |

|---|---|---|

| 50-Day Moving Average | $6.65 | Suggests a slightly upward trend |

| 200-Day Moving Average | $6.40 | Provides support for the current price |

| RSI | 60 | Indicates neither overbought nor oversold conditions |

Analyst Ratings and Price Targets

Analyst ratings and price targets provide a range of opinions on BB’s future performance. These predictions are based on various factors, including financial forecasts, market analysis, and company-specific assessments.

- Analyst A: Buy rating, $8 price target (Reasoning: Positive outlook based on strong product pipeline)

- Analyst B: Hold rating, $7 price target (Reasoning: Cautious outlook due to competitive pressures)

- Analyst C: Sell rating, $6 price target (Reasoning: Concerns about slowing revenue growth)

Query Resolution: Bb Stock Price Today

What are the risks associated with investing in BB stock?

Investing in any stock carries inherent risks, including potential for loss of principal. BB stock’s price is subject to market volatility and influenced by various factors, some unpredictable. Thorough research and risk assessment are crucial before investing.

Where can I find real-time BB stock price updates?

Real-time BB stock price updates are available through major financial websites and brokerage platforms. These platforms often provide detailed charts, historical data, and news related to the stock.

How often is BB stock price data updated?

BB stock price data is typically updated in real-time during trading hours, reflecting every transaction. After market close, the data might be updated less frequently, depending on the source.