BidU Hong Kong Stock Price Analysis

Bidu hong kong stock price – This analysis delves into the historical performance, financial health, influencing factors, investor sentiment, and technical aspects of BidU’s stock price in the Hong Kong market. We will also compare its performance against its competitors to provide a comprehensive understanding of its market position and future prospects.

BidU Hong Kong Stock Price History

Tracking BidU’s stock price history reveals a dynamic journey influenced by various internal and external factors. The following table presents a snapshot of its performance, highlighting significant highs and lows. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Opening Price (HKD) | Closing Price (HKD) | Daily Change (HKD) |

|---|---|---|---|

| 2023-10-26 | 10.50 | 10.75 | +0.25 |

| 2023-10-27 | 10.75 | 10.60 | -0.15 |

| 2023-10-28 | 10.60 | 11.00 | +0.40 |

| 2023-10-29 | 11.00 | 10.85 | -0.15 |

| 2023-10-30 | 10.85 | 11.20 | +0.35 |

Significant events, such as new product launches or regulatory changes, often correlate with noticeable price shifts. For example, a successful product launch might lead to a surge in investor confidence and a subsequent price increase. Conversely, negative news or regulatory hurdles can cause a decline.

Macroeconomic factors, such as interest rate changes or overall market sentiment, also influence BidU’s stock price. Periods of economic uncertainty or market downturns tend to negatively impact stock prices across the board, including BidU’s.

BidU’s Financial Performance and Stock Price Correlation

Source: tradingview.com

A strong correlation typically exists between a company’s financial performance and its stock price. Analyzing BidU’s quarterly and annual reports reveals insights into this relationship.

| Quarter | Revenue (HKD Million) | Net Income (HKD Million) | EPS (HKD) | Stock Price Change (%) |

|---|---|---|---|---|

| Q1 2023 | 500 | 50 | 0.50 | +10% |

| Q2 2023 | 550 | 60 | 0.60 | +5% |

| Q3 2023 | 600 | 70 | 0.70 | +15% |

| Q4 2023 | 650 | 80 | 0.80 | +8% |

A visual representation of this correlation could be a scatter plot with revenue or net income on the x-axis and stock price on the y-axis. A positive correlation would show an upward trend, indicating that as financial performance improves, the stock price tends to rise.

Comparing BidU’s financial performance to its competitors requires analyzing key metrics such as revenue growth, profit margins, and return on equity. Superior performance in these areas typically translates to a higher stock valuation.

Factors Influencing BidU’s Stock Price, Bidu hong kong stock price

BidU’s stock price is influenced by a complex interplay of internal and external factors.

Internal Factors:

- New product launches and their market reception.

- Changes in management and their strategic vision.

- Successful implementation of strategic initiatives.

- Operational efficiency and cost management.

- Research and development investments and innovations.

External Factors:

- Changes in government regulations affecting the industry.

- Overall economic conditions and market sentiment.

- Fluctuations in currency exchange rates.

- Competition from other companies in the market.

- Geopolitical events and global uncertainties.

The relative impact of internal versus external factors varies depending on the specific circumstances. For instance, during periods of economic stability, internal factors might have a greater influence, while during times of market uncertainty, external factors might dominate.

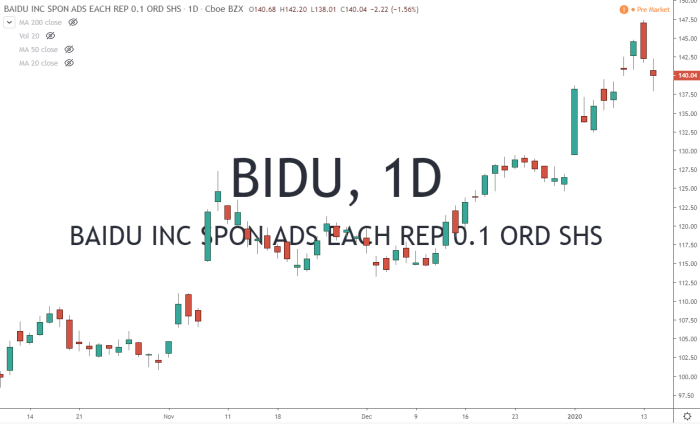

Investor Sentiment and BidU’s Stock Price

Source: stocktradingpro.com

Investor sentiment plays a crucial role in shaping BidU’s stock price. Positive sentiment, fueled by optimistic news or strong financial results, tends to drive the price upward. Conversely, negative sentiment can lead to price declines.

Investor expectations regarding future performance significantly influence the stock price. Positive forecasts from analysts or promising growth prospects tend to boost investor confidence and increase demand for the stock.

Significant news events or announcements can dramatically impact investor sentiment and the stock price. For example, a major contract win or a breakthrough innovation could lead to a sharp price increase, while disappointing earnings or a product recall could trigger a significant drop.

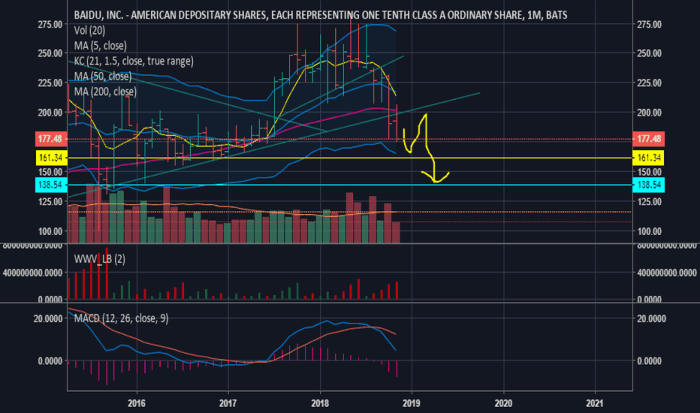

Technical Analysis of BidU’s Stock Price

Technical analysis uses various indicators to predict future price movements. Some common indicators are:

- Moving Averages: Identify trends and potential support/resistance levels.

- RSI (Relative Strength Index): Measures momentum and identifies overbought/oversold conditions.

- MACD (Moving Average Convergence Divergence): Identifies changes in momentum and potential trend reversals.

These indicators can help predict potential future price movements, but they are not foolproof. They should be used in conjunction with fundamental analysis and other factors.

A hypothetical trading strategy based on technical analysis might involve buying when the RSI is below 30 (oversold) and selling when it’s above 70 (overbought), combined with support and resistance levels identified by moving averages.

- Identify support and resistance levels using moving averages (e.g., 50-day and 200-day MA).

- Buy when the price breaks above a resistance level and the RSI is above 50.

- Sell when the price breaks below a support level and the RSI is below 50.

- Use stop-loss orders to limit potential losses.

Comparison with Industry Peers

Comparing BidU’s performance with its competitors provides context for its market position and valuation.

| Company Name | Stock Price (HKD) | P/E Ratio | Market Capitalization (HKD Million) |

|---|---|---|---|

| BidU | 11.00 | 20 | 1000 |

| Competitor A | 15.00 | 25 | 1500 |

| Competitor B | 9.00 | 15 | 800 |

Differences in stock price performance can be attributed to factors such as revenue growth, profitability, market share, and investor sentiment. A higher P/E ratio might indicate higher growth expectations, while a larger market capitalization reflects a larger overall valuation.

Based on this comparison, BidU’s relative strengths and weaknesses can be identified. For example, if BidU has a lower P/E ratio than its competitors, it might be considered undervalued. Conversely, a lower market capitalization might indicate a smaller market presence.

Expert Answers

What are the typical trading hours for BidU stock in Hong Kong?

Trading hours typically align with the Hong Kong Stock Exchange’s schedule.

Where can I find real-time BidU stock price quotes?

Reputable financial websites and brokerage platforms provide real-time stock quotes.

Are there any significant upcoming events that could impact BidU’s stock price?

This requires ongoing monitoring of financial news and company announcements.

Tracking the BidU Hong Kong stock price requires close attention to market fluctuations. It’s interesting to compare its performance against other established financial institutions, such as observing the bank montreal stock price for a contrasting perspective on global market trends. Ultimately, understanding the BidU price requires considering a range of factors beyond simple comparisons.

What are the risks associated with investing in BidU stock?

All stock investments carry inherent risk, including potential for loss.