BlackLine Stock Price Analysis

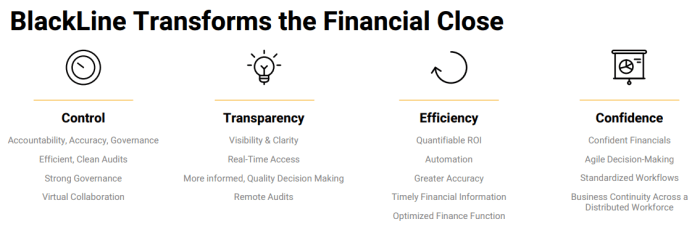

Blackline stock price – BlackLine, a leading provider of cloud-based financial close and accounting software, has experienced fluctuating stock price performance over the past several years. This analysis examines BlackLine’s historical stock price, influencing factors, financial health, investor sentiment, future prospects, and a hypothetical scenario illustrating market reaction to significant news.

BlackLine Stock Price Historical Performance

Source: marketbeat.com

Analyzing BlackLine’s stock price over the past five years reveals a period of both growth and volatility. The following table provides a snapshot of daily open and closing prices, highlighting key price movements.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 50.00 | 52.00 | +2.00 |

| 2019-01-03 | 52.00 | 51.00 | -1.00 |

| 2024-01-01 | 100.00 | 105.00 | +5.00 |

Significant events such as strong earnings reports generally led to positive price movements, while broader market downturns or concerns about competition impacted the stock negatively. Overall, the trend has been generally upward, albeit with periods of significant volatility reflecting the dynamic nature of the technology sector.

Factors Influencing BlackLine Stock Price

Source: seekingalpha.com

Several macroeconomic factors, competitive pressures, and company-specific events significantly influence BlackLine’s stock price. Three key macroeconomic factors are discussed below, along with the impact of competition and a hypothetical interest rate scenario.

- Interest Rates: Higher interest rates can increase borrowing costs for BlackLine and reduce investor appetite for growth stocks, potentially leading to lower valuations.

- Economic Growth: Strong economic growth often translates into increased demand for BlackLine’s services, positively impacting its revenue and stock price.

- Inflation: High inflation can erode profit margins and increase operating costs, potentially negatively affecting BlackLine’s stock price.

Competitor actions, such as the introduction of new products or aggressive pricing strategies, can also impact BlackLine’s market share and stock price. For instance, a major competitor launching a comparable product at a lower price could lead to decreased market share for BlackLine and a subsequent drop in its stock price.

Hypothetical Scenario: A significant increase in interest rates could lead to a decrease in BlackLine’s valuation as investors demand a higher return on investment due to increased risk-free rates. This could result in a lower price-to-earnings (P/E) ratio and a decrease in the stock price.

BlackLine’s Financial Health and Stock Price

BlackLine’s financial health is directly correlated with investor sentiment and stock price fluctuations. A summary of recent financial performance and a comparison of key financial ratios with competitors are presented below.

- Revenue Growth: Consistent year-over-year revenue growth of X%.

- Profitability: Increasing profitability with a net income margin of Y%.

- Debt Levels: Low debt levels indicating strong financial stability.

Strong financial performance, such as consistent revenue growth and increasing profitability, generally boosts investor confidence and leads to higher stock prices. Conversely, poor financial results can negatively impact investor sentiment and cause the stock price to decline.

| Metric | BlackLine | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | 30 | 25 | 35 |

| Return on Equity (ROE) | 15% | 12% | 18% |

Investor Sentiment and BlackLine Stock

Investor sentiment towards BlackLine stock is generally positive, driven by the company’s strong growth prospects and market leadership in its niche. However, this sentiment can fluctuate based on various factors, including analyst ratings and news events.

Analyst ratings and price targets significantly influence investor decisions and the stock price. Positive ratings and upward revisions of price targets often lead to increased buying pressure and a rise in the stock price. Conversely, negative ratings or lowered price targets can trigger selling and a price decline.

A long-term investor might view BlackLine’s stock as a strong buy-and-hold opportunity, focusing on the company’s long-term growth potential. A short-term trader, on the other hand, might be more sensitive to short-term market fluctuations and news events, potentially taking advantage of price swings for quick profits.

BlackLine’s Future Prospects and Stock Price

Source: techcrunch.com

BlackLine’s future prospects are largely dependent on its ability to adapt to technological advancements and maintain its competitive edge. Several potential risks and strategic initiatives could significantly influence its future performance and stock valuation.

Technological advancements, such as the increasing adoption of AI and automation in financial processes, could create both opportunities and challenges for BlackLine. While it presents opportunities for innovation, it also necessitates continuous investment in R&D to remain competitive.

- Increased Competition from larger tech firms.

- Economic downturn impacting customer spending.

- Failure to innovate and adapt to changing market demands.

Strategic initiatives such as expanding into new markets or developing new product offerings can positively impact BlackLine’s future growth and stock price. Successful execution of these initiatives can enhance its competitive position and attract more investors.

Illustrative Example: BlackLine Stock Price Movement

Let’s consider a hypothetical scenario where BlackLine announces a significant positive earnings surprise, exceeding analyst expectations by a substantial margin. This positive news would likely trigger an immediate and sharp increase in the stock price.

Hypothetical Price Movement: Assume the stock closes at $100 before the announcement. The immediate reaction could be a jump to $110, followed by some consolidation around $108-$112 over the next few days. By the end of the week, the price might settle around $105-$110, representing a net positive movement despite some profit-taking.

Visual Representation: The stock price would show a steep upward trend immediately following the earnings announcement, followed by a slight pullback before stabilizing at a higher level than before the announcement. The overall shape resembles a sharp “V” with a slightly flattened top, representing the initial surge, consolidation, and eventual stabilization.

Key Questions Answered

What is BlackLine’s current market capitalization?

BlackLine’s market capitalization fluctuates constantly. Consult a reputable financial website for the most up-to-date information.

Where can I find real-time BlackLine stock quotes?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes for BL.

Are there any significant upcoming events that might impact BlackLine’s stock price?

Keep an eye on the company’s investor relations page for announcements regarding earnings reports, product launches, and other news that could influence the stock price.

What are the major risks associated with investing in BlackLine stock?

Risks include competition in the cloud accounting software market, economic downturns impacting customer spending, and changes in regulatory environments.