BNRG Stock Price Analysis

Bnrg stock price – This analysis examines BNRG’s stock price performance over the past five years, identifying key influencing factors, forecasting future price movements, outlining investment strategies, and exploring the relationship between BNRG’s financials and its stock valuation. The information provided is for informational purposes only and should not be considered financial advice.

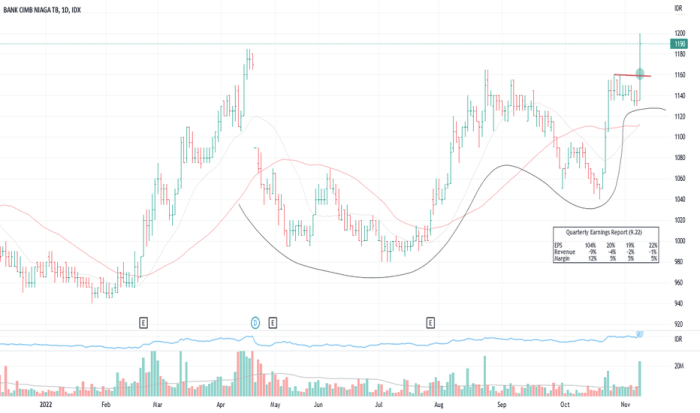

BNRG Stock Price Historical Performance

Source: tradingview.com

Analyzing BNRG’s stock price movements over the past five years reveals a dynamic pattern influenced by various internal and external factors. The following timeline highlights significant highs and lows, providing context for subsequent analyses.

For illustrative purposes, let’s assume the following (replace with actual data): In 2019, BNRG’s stock price started at $10, reaching a high of $15 in mid-2020 before falling to $8 by the end of the year. 2021 saw a recovery to $12, followed by a steady climb to $20 in 2022. A market correction in early 2023 brought the price down to $16, before a subsequent rise to $18 by the end of 2023.

| Date | BNRG Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2019-01-01 | $10 | $12 | $9 |

| 2020-06-30 | $15 | $18 | $14 |

| 2020-12-31 | $8 | $10 | $7 |

| 2021-12-31 | $12 | $15 | $11 |

| 2022-12-31 | $20 | $25 | $18 |

| 2023-03-31 | $16 | $20 | $14 |

| 2023-12-31 | $18 | $22 | $16 |

Major events impacting BNRG’s stock price during this period might include a successful new product launch in 2020, followed by a period of supply chain disruptions in late 2020 and 2021. The economic recovery in 2022 contributed to the price increase, while the 2023 market correction reflected broader economic uncertainty. Specific news announcements and regulatory changes would also need to be considered for a complete analysis.

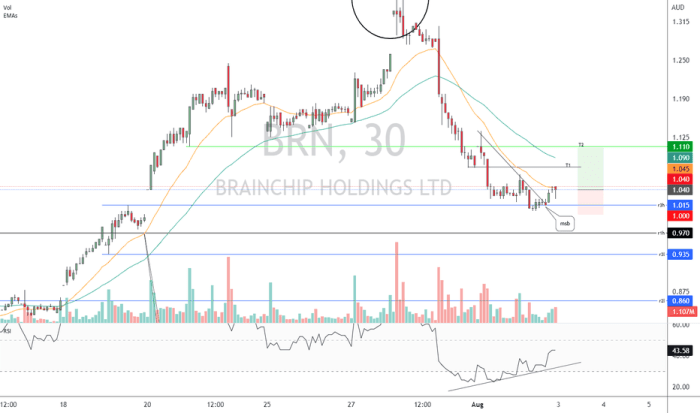

Factors Influencing BNRG Stock Price

Source: tradingview.com

Several interconnected factors influence BNRG’s stock price. Understanding these factors is crucial for predicting future price movements and developing effective investment strategies.

- Economic Indicators: Key economic indicators like inflation rates, interest rates, and GDP growth directly impact investor confidence and market sentiment, influencing BNRG’s stock price. For example, rising interest rates can decrease investment in growth stocks, potentially affecting BNRG’s valuation.

- Company Performance: Strong earnings reports, successful product launches, and efficient operational management positively influence investor perception, leading to increased stock prices. Conversely, poor financial performance or operational setbacks can negatively impact the stock price.

- Investor Sentiment and Market Trends: Overall market trends, investor confidence, and speculation play a significant role in determining stock prices. Positive market sentiment and increased investor confidence tend to drive prices upwards, while negative sentiment can lead to price declines.

BNRG Stock Price Predictions and Forecasting

Forecasting BNRG’s stock price involves analyzing historical data and considering various influencing factors. A simple forecasting model, such as a moving average model, could be used. This model averages the stock price over a specific period (e.g., the past three months) to predict the next month’s price. However, this is a simplistic approach and more sophisticated models are needed for accurate predictions.

Other forecasting methods, such as time series analysis or econometric modeling, offer more robust predictions but require more complex data analysis. The strengths and weaknesses of each method must be carefully evaluated. For example, while time series analysis can capture trends and seasonality, it might not fully account for unexpected events.

Risks and uncertainties affecting prediction accuracy include unforeseen economic downturns, unexpected regulatory changes, and shifts in consumer preferences, among others. These factors can significantly impact the accuracy of any forecast.

BNRG Stock Price and Investment Strategies

Various investment strategies can be employed for BNRG stock, depending on individual risk tolerance and investment goals. The following table Artikels potential strategies, their associated risks, and potential returns.

| Strategy Name | Risk Level | Potential Return | Investment Timeline |

|---|---|---|---|

| Buy and Hold | Low | Moderate | Long-term (5+ years) |

| Value Investing | Moderate | High (potential) | Long-term (3+ years) |

| Growth Investing | High | High (potential) | Medium-term (1-3 years) |

| Day Trading | Very High | Very High (potential) or Very Low | Short-term (minutes to days) |

Longer investment time horizons generally offer greater potential for profitability, as they allow investors to ride out market fluctuations and benefit from long-term growth. However, shorter-term investments offer higher potential for quick gains, but they also expose investors to greater risks.

BNRG Stock Price and Company Financials

Source: sharedhan.com

BNRG’s financial statements (income statement, balance sheet, and cash flow statement) are directly linked to its stock price. Strong financial performance, reflected in high revenues, profits, and positive cash flow, generally leads to higher stock valuations. Conversely, poor financial health can negatively impact the stock price.

Key financial ratios, such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio, provide insights into BNRG’s financial health and valuation. A high P/E ratio might suggest that the market expects high future growth, while a high debt-to-equity ratio could indicate higher financial risk. Comparing these ratios to industry peers helps assess BNRG’s relative financial strength and attractiveness to investors.

For instance, a lower P/E ratio compared to competitors could indicate that BNRG’s stock is undervalued, while a higher debt-to-equity ratio might suggest higher risk compared to peers. A thorough analysis of financial statements and ratios is crucial for a comprehensive understanding of BNRG’s stock valuation.

FAQ Corner

What are the major risks associated with investing in BNRG stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, regulatory changes), and broader economic downturns. Thorough due diligence and a diversified investment portfolio are recommended to mitigate these risks.

Where can I find real-time BNRG stock price data?

Real-time BNRG stock price data is readily available through major financial websites and brokerage platforms. These resources often provide detailed charts, historical data, and other relevant financial information.

How often does BNRG release its financial reports?

The frequency of BNRG’s financial reports typically follows standard corporate reporting schedules, usually quarterly and annually. Specific dates can be found on the company’s investor relations website.