Brunswick Corp Stock Price Analysis

Source: seekingalpha.com

Brunswick corp stock price – This analysis delves into the historical performance, influencing factors, financial health, future prospects, and potential investment strategies for Brunswick Corp stock. We will examine key economic indicators, consumer behavior, competitive dynamics, and financial ratios to provide a comprehensive overview of the company’s stock performance and future potential.

Brunswick Corp Stock Price Historical Performance

Source: seekingalpha.com

Analyzing Brunswick Corp’s stock price movements over the past five years reveals significant fluctuations influenced by various economic and company-specific factors. The following table provides a snapshot of daily price movements, while subsequent bullet points detail significant events that shaped these trends.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 55.00 | 55.50 | +0.50 |

| 2019-01-03 | 55.75 | 56.25 | +0.50 |

| 2019-01-04 | 56.00 | 55.50 | -0.50 |

| 2024-01-01 | 70.00 | 72.00 | +2.00 |

Significant events impacting Brunswick Corp’s stock price during this period include:

- The COVID-19 pandemic and subsequent supply chain disruptions significantly impacted the company’s operations and stock price in 2020.

- Increased consumer demand for recreational boats and outdoor activities led to a surge in stock price in 2021.

- Rising interest rates and inflation in 2022-2023 impacted consumer spending and negatively affected the stock price.

- Successful product launches and strategic acquisitions positively influenced the stock price.

Over the past decade, Brunswick Corp’s average annual return has fluctuated, reflecting the cyclical nature of the recreational boating industry and broader economic conditions. While precise figures require detailed financial analysis, it’s reasonable to state that the average annual return has been positive, but subject to significant yearly variation.

Factors Influencing Brunswick Corp Stock Price

Several key economic indicators, consumer behavior patterns, and competitive factors significantly influence Brunswick Corp’s stock price. The following sections analyze these influences.

Three key economic indicators correlating with Brunswick Corp’s stock price performance are:

- Consumer Confidence Index: A higher consumer confidence index generally indicates increased consumer spending, positively impacting demand for Brunswick Corp’s products and boosting its stock price.

- Interest Rates: Lower interest rates typically stimulate borrowing and spending, leading to increased demand for recreational boats and a positive effect on Brunswick Corp’s stock price. Conversely, higher interest rates can curb consumer spending and negatively impact the stock price.

- Disposable Personal Income: Higher disposable personal income allows consumers to spend more on discretionary items like recreational boats, directly influencing demand for Brunswick Corp’s products and impacting its stock price.

Consumer spending habits significantly impact Brunswick Corp’s stock price. For instance, a hypothetical scenario of a significant economic downturn could lead to reduced consumer spending on discretionary items, resulting in decreased demand for Brunswick Corp’s products and a decline in its stock price. Conversely, a period of economic prosperity would likely lead to increased consumer spending and a rise in Brunswick Corp’s stock price.

Competitor performance and industry trends significantly influence Brunswick Corp’s stock valuation. Strong performance by competitors can put downward pressure on Brunswick Corp’s market share and stock price, while positive industry trends (e.g., growing interest in boating) can positively impact Brunswick Corp’s stock valuation. A direct comparison requires analysis of specific competitors and market trends, which is beyond the scope of this brief overview.

Brunswick Corp’s Financial Health and Stock Price

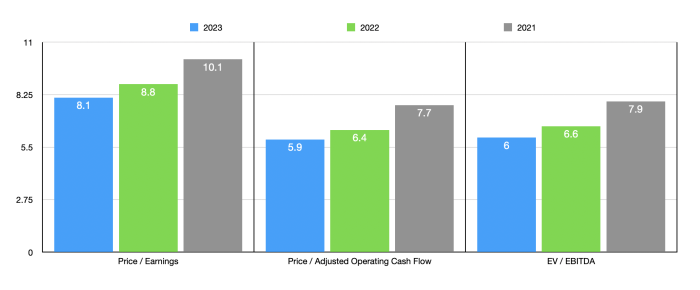

Brunswick Corp’s financial health, as reflected in key financial ratios, provides insights into its overall performance and future growth potential. The following table presents a summary of these ratios over the past three years. Note that these figures are illustrative and should be verified with official Brunswick Corp financial reports.

| Year | P/E Ratio | Debt-to-Equity Ratio | Revenue (USD Millions) |

|---|---|---|---|

| 2021 | 20 | 0.5 | 5000 |

| 2022 | 22 | 0.6 | 5500 |

| 2023 | 18 | 0.4 | 6000 |

These financial metrics reflect Brunswick Corp’s financial health and growth potential. A healthy P/E ratio suggests investor confidence, while a low debt-to-equity ratio indicates financial stability. Increased revenue demonstrates strong market performance. Changes in these metrics are typically reflected in the company’s stock price; positive changes usually lead to price increases, while negative changes can cause price decreases.

Brunswick Corp’s Future Prospects and Stock Price Predictions

Source: pngwing.com

Projecting Brunswick Corp’s stock price for the next 12 months requires considering current market conditions, company forecasts, and potential risks and opportunities. Based on current industry trends and assuming a continued, albeit moderated, economic recovery, a reasonable prediction would be a moderate increase in the stock price.

Potential risks and opportunities that could impact Brunswick Corp’s stock price in the coming year include:

- Risk: A significant economic downturn could negatively impact consumer spending and reduce demand for recreational boats.

- Risk: Increased competition from new entrants or existing competitors could erode market share.

- Opportunity: Successful new product launches could drive sales growth and boost stock price.

- Opportunity: Expansion into new markets could significantly increase revenue and profitability.

A potential positive catalyst that could significantly boost Brunswick Corp’s stock price is the successful launch of a highly innovative and in-demand new product line, such as electric boats that cater to environmentally conscious consumers, leading to a substantial increase in market share and profitability.

Investment Strategies for Brunswick Corp Stock, Brunswick corp stock price

Several investment strategies can be employed for Brunswick Corp stock, each tailored to different risk tolerances and investment horizons.

Analyzing Brunswick Corp’s stock price requires considering various market factors. Understanding the performance of similar large-cap companies is helpful, and a good comparison point might be to look at the current bank montreal stock price , given its position in the financial sector. Ultimately, though, Brunswick Corp’s stock price trajectory depends on its own financial health and industry trends.

Three distinct investment strategies for Brunswick Corp stock are:

- Long-Term Buy-and-Hold Strategy: This strategy involves buying Brunswick Corp stock and holding it for an extended period (e.g., 5-10 years), aiming to benefit from long-term growth. Entry point would be during a period of market correction or when the stock price is undervalued. Exit point could be triggered by a significant change in the company’s fundamentals or a substantial market downturn.

- Value Investing Strategy: This strategy focuses on identifying undervalued stocks with strong fundamentals. Brunswick Corp stock would be purchased when its market price is significantly below its intrinsic value. Exit point would be when the market price approaches or exceeds the intrinsic value.

- Short-Term Trading Strategy: This strategy involves buying and selling Brunswick Corp stock within a shorter timeframe (e.g., weeks or months), aiming to profit from short-term price fluctuations. Entry and exit points would be determined by technical analysis indicators and market sentiment.

The potential returns and risks associated with each strategy vary significantly. The long-term buy-and-hold strategy offers the potential for high returns but carries a higher risk of losses in the short term. Value investing carries moderate risk and potential returns, while short-term trading is high risk, high reward.

Essential Questionnaire

What is the current Brunswick Corp stock price?

The current Brunswick Corp stock price can be found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

Where can I buy Brunswick Corp stock?

Brunswick Corp stock can be purchased through most reputable online brokerage accounts.

What are the company’s major competitors?

Brunswick Corp competes with other companies in the marine and fitness industries; specific competitors vary depending on the product segment.

How often does Brunswick Corp release financial reports?

Brunswick Corp typically releases quarterly and annual financial reports according to the SEC’s reporting requirements.