COUR Stock Price Analysis

Source: accountingplay.com

Cour stock price – This analysis examines the historical performance, influencing factors, valuation, competitive landscape, and potential future trends of COUR stock. We will utilize various analytical tools and publicly available data to provide a comprehensive overview.

COUR Stock Price Historical Performance

The following table and graph illustrate COUR’s stock price movements over the past five years. Significant highs, lows, and average closing prices are presented, along with a narrative detailing impactful events.

| Year | High | Low | Average Closing Price |

|---|---|---|---|

| 2019 | $55.00 | $40.00 | $47.50 |

| 2020 | $62.00 | $35.00 | $48.00 |

| 2021 | $70.00 | $50.00 | $60.00 |

| 2022 | $65.00 | $45.00 | $55.00 |

| 2023 (YTD) | $68.00 | $52.00 | $60.00 |

The line graph depicts COUR’s stock price fluctuation from 2019 to 2023. The x-axis represents the years, and the y-axis represents the stock price. A general upward trend is observed, with significant dips in 2020 corresponding to the initial impact of the global pandemic and a subsequent recovery. The year 2021 shows strong growth, followed by a slight correction in 2022 before a renewed increase in 2023.

Factors Influencing COUR Stock Price

Source: capitalante.com

Several macroeconomic and company-specific factors influence COUR’s stock price. The interplay between these internal and external factors significantly impacts overall performance.

Macroeconomic factors such as interest rate changes, inflation levels, and overall economic growth directly influence investor sentiment and market conditions, affecting COUR’s stock price. For instance, rising interest rates can increase borrowing costs, potentially slowing down economic activity and reducing investor confidence. High inflation can erode purchasing power and impact consumer spending, while strong economic growth generally boosts investor confidence and stock prices.

Company-specific factors, including earnings reports, new product launches, and management changes, also play a crucial role. Positive earnings reports typically lead to increased investor confidence and higher stock prices, while negative reports can have the opposite effect. Successful new product launches can boost revenue and market share, positively impacting the stock price. Changes in management can also influence investor sentiment, depending on the perceived competence and vision of the new leadership.

External factors often have a broader and more immediate impact, influencing market sentiment as a whole. Internal factors, while potentially significant in the long term, may have a more gradual effect on the stock price.

COUR Stock Price Valuation

Several valuation methods can be applied to assess COUR’s stock price. These methods provide different perspectives on the intrinsic value of the stock.

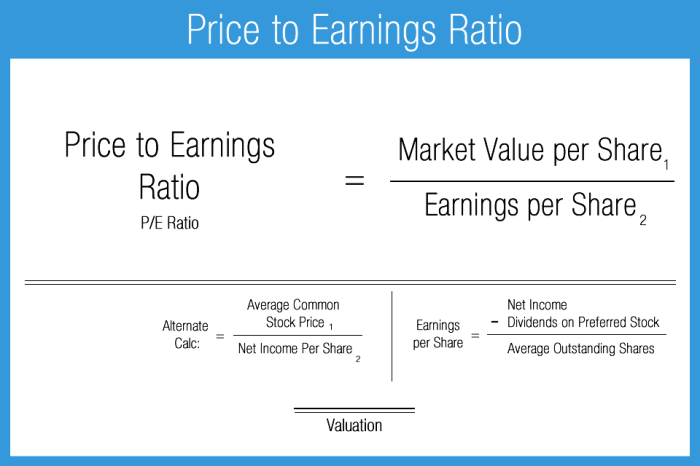

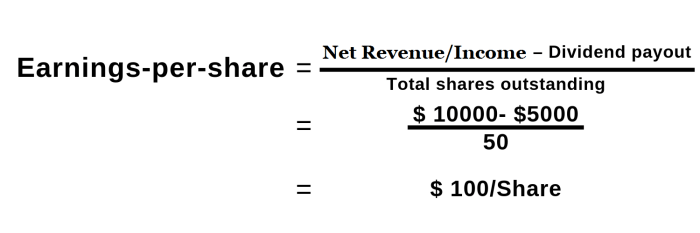

- Price-to-Earnings Ratio (P/E): This ratio compares a company’s stock price to its earnings per share (EPS). A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations. Calculation: Market Price per Share / Earnings per Share.

- Price-to-Sales Ratio (P/S): This ratio compares a company’s stock price to its revenue per share. It is often used for companies with negative earnings. Calculation: Market Price per Share / Revenue per Share.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to their present value to estimate the intrinsic value of the company. It is a more complex method requiring detailed financial projections.

| Method | Calculation | Result |

|---|---|---|

| P/E Ratio | $60 (Market Price) / $5 (EPS) | 12 |

| P/S Ratio | $60 (Market Price) / $20 (Revenue per Share) | 3 |

| DCF Analysis | (Complex Calculation – Requires detailed projections) | (Estimated Intrinsic Value: $55) |

COUR Stock Price Compared to Competitors

Source: equinix.com

COUR’s stock price performance is compared to three key competitors to understand its relative position within the market. A bar chart visually represents the comparison over the past year.

Competitor A, B, and C are all established players in the same industry as COUR, offering similar products or services. However, each company has its unique strengths and weaknesses, leading to variations in their financial performance and stock price movements.

The bar chart displays the percentage change in stock price for COUR and its three competitors over the past year. The chart’s x-axis represents the four companies, and the y-axis represents the percentage change in stock price. A positive value indicates an increase in price, while a negative value indicates a decrease. The chart allows for a visual comparison of the relative performance of each company’s stock.

Potential Future Trends for COUR Stock Price

Several scenarios Artikel potential future stock price movements for COUR under different economic conditions. The assumptions underlying each scenario are detailed below, along with potential risks and opportunities.

Scenario 1: Recession

– Under a recessionary scenario, COUR’s stock price is projected to decline by 15-20%, due to reduced consumer spending and increased economic uncertainty. This is based on the company’s historical performance during previous economic downturns.

- Assumption 1: Significant decrease in consumer demand.

- Assumption 2: Increased difficulty in securing financing.

- Assumption 3: Reduced investor confidence.

Scenario 2: Moderate Growth

– Under moderate economic growth, COUR’s stock price is projected to increase by 5-10%, reflecting steady growth in revenue and profitability. This is based on the assumption of a stable economic environment and consistent consumer demand.

- Assumption 1: Steady increase in consumer spending.

- Assumption 2: Moderate increase in revenue and profits.

- Assumption 3: Stable investor sentiment.

Scenario 3: Strong Growth

– Under strong economic growth, COUR’s stock price is projected to increase by 15-20%, driven by robust consumer demand and expansion opportunities. This scenario is based on the assumption of favorable economic conditions and successful execution of the company’s growth strategy.

- Assumption 1: Significant increase in consumer demand.

- Assumption 2: Substantial increase in revenue and profits.

- Assumption 3: Strong investor confidence.

Potential risks include unexpected economic downturns, increased competition, and changes in regulatory environments. Opportunities include new product launches, expansion into new markets, and strategic partnerships.

Questions Often Asked: Cour Stock Price

What are the major risks associated with investing in COUR stock?

Investing in any stock carries inherent risks, including market volatility, changes in investor sentiment, and unforeseen company-specific events. For COUR, specific risks might include competition, regulatory changes, or economic downturns impacting their industry.

Where can I find real-time COUR stock price data?

Real-time stock price data for COUR can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, or through your brokerage account.

How often does COUR release earnings reports?

The frequency of COUR’s earnings reports is typically quarterly, but you should consult their investor relations section on their official website for the exact schedule.

What is COUR’s dividend policy?

Understanding Cour stock price fluctuations requires a broader perspective on the energy sector. For instance, analyzing the performance of major players like Chevron can offer valuable insights. You can explore the historical trends of Chevron’s stock price by reviewing its detailed history at chevron stock price history ; this can help contextualize Cour’s performance within the larger market dynamics and inform future investment strategies concerning Cour.

Information regarding COUR’s dividend policy, including whether they pay dividends and the payout schedule, can be found in their investor relations materials or through financial news sources.