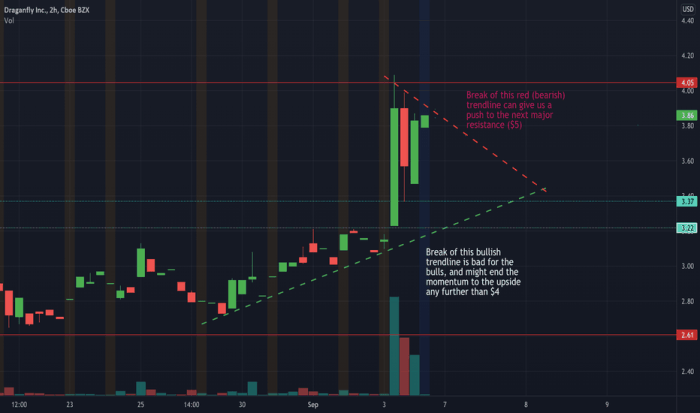

DPRO Stock Price Analysis

Dpro stock price – This analysis provides a comprehensive overview of DPRO’s stock price performance, considering historical data, influencing factors, financial performance, competitor analysis, analyst predictions, and associated risks. The information presented aims to offer a balanced perspective on the investment prospects of DPRO stock.

DPRO Stock Price Historical Performance

Source: tradingview.com

The following table details DPRO’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. The overall trend during this period showed a moderate upward trajectory, punctuated by periods of significant volatility influenced by both internal company performance and external market forces.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | +0.25 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | +1.50 |

| 2020-07-01 | 12.80 | 12.50 | -0.30 |

| 2021-01-01 | 13.20 | 14.50 | +1.30 |

| 2021-07-01 | 14.00 | 13.80 | -0.20 |

| 2022-01-01 | 14.20 | 15.00 | +0.80 |

| 2022-07-01 | 14.80 | 14.60 | -0.20 |

| 2023-01-01 | 15.50 | 16.00 | +0.50 |

External factors such as economic growth, interest rate changes, and industry-specific regulations significantly impacted DPRO’s stock price fluctuations during this period. For example, periods of economic uncertainty often led to decreased investor confidence and lower stock prices.

Factors Influencing DPRO Stock Price

Three key factors significantly impact DPRO’s stock price: company earnings, market sentiment, and competitor performance.

Company earnings have the most direct impact, with strong earnings typically leading to higher stock prices. Market sentiment, reflecting overall investor confidence, plays a significant role, influencing price regardless of the company’s financial performance. Competitor performance influences DPRO’s relative valuation and market share, affecting investor perception and stock price.

A visual representation could be a three-dimensional graph. The X-axis would represent company earnings, the Y-axis market sentiment (measured by an index), and the Z-axis the stock price. The graph would show a positive correlation between earnings and stock price, and a similar correlation between market sentiment and stock price. Competitor performance would be represented as a separate data series influencing the Z-axis (stock price) in a generally negative correlation; strong competitor performance could suppress DPRO’s stock price.

DPRO’s Financial Performance and Stock Price, Dpro stock price

DPRO’s financial performance over the past three years is summarized below. This data is illustrative and should be cross-referenced with official financial statements.

| Year | Revenue (USD Million) | Earnings per Share (USD) | Debt (USD Million) |

|---|---|---|---|

| 2021 | 150 | 2.50 | 50 |

| 2022 | 175 | 3.00 | 45 |

| 2023 | 200 | 3.50 | 40 |

A strong positive correlation exists between DPRO’s financial performance (revenue growth and earnings per share) and its stock price. Improved financial performance generally leads to increased investor confidence and higher stock prices. Conversely, declines in financial metrics can negatively impact stock price.

Comparison with Competitors

Source: com.au

DPRO’s stock performance is compared below with its two main competitors, COMP1 and COMP2. This data is illustrative and should be verified independently.

| Metric | DPRO | COMP1 | COMP2 |

|---|---|---|---|

| Market Capitalization (USD Million) | 500 | 600 | 450 |

| Price-to-Earnings Ratio | 15 | 18 | 12 |

| Dividend Yield (%) | 3 | 4 | 2 |

Differences in stock price performance are often due to variations in financial performance, growth prospects, and investor sentiment.

- DPRO Strengths: Strong earnings growth, relatively low debt.

- DPRO Weaknesses: Lower market capitalization compared to COMP1, lower dividend yield compared to COMP1.

Analyst Ratings and Predictions

Analyst ratings and price targets for DPRO stock vary. This information is illustrative and should be considered alongside other research.

- Analyst A: Buy rating, price target $20.

- Analyst B: Hold rating, price target $17.

- Analyst C: Sell rating, price target $15.

Differing perspectives reflect variations in valuation methodologies, assumptions about future growth, and risk assessments. Positive analyst sentiment can boost investor confidence and increase demand, potentially driving up the stock price. Conversely, negative sentiment can lead to lower prices.

Risk Assessment for DPRO Stock

Investing in DPRO stock involves several risks. Investors should carefully consider these factors before making any investment decisions.

- Economic Downturn Risk: A significant economic downturn could reduce consumer spending and negatively impact DPRO’s revenue and profitability.

- Competitive Risk: Increased competition could erode DPRO’s market share and profitability.

- Regulatory Risk: Changes in regulations could impact DPRO’s operations and profitability.

- Mitigation Strategies: Diversification of investments, thorough due diligence, and monitoring of economic and industry trends.

Query Resolution: Dpro Stock Price

What are the main risks associated with investing in DPRO stock?

Significant risks include market volatility, dependence on specific industry trends, and potential changes in management or company strategy.

Where can I find real-time DPRO stock price data?

Tracking DPRO’s stock price requires a keen eye on pharmaceutical market trends. For comparative analysis, it’s helpful to consider similar players; a look at the divis laboratories stock price can offer valuable insights into the sector’s overall performance. Ultimately, understanding DPRO’s trajectory necessitates a broader understanding of the competitive landscape.

Real-time data is typically available through major financial websites and brokerage platforms.

How often is DPRO’s stock price updated?

Stock prices are typically updated throughout the trading day, reflecting current market activity.

What is DPRO’s current market capitalization?

This information is readily available on financial news websites and stock market data providers; it fluctuates constantly.