ExxonMobil Stock Price Analysis

Source: investorplace.com

Exxon current stock price – ExxonMobil, a global energy giant, experiences significant stock price fluctuations influenced by various internal and external factors. This analysis delves into the current stock price, key influencing factors, financial performance, business strategy, analyst predictions, investor sentiment, and dividend policy to provide a comprehensive overview of ExxonMobil’s stock performance.

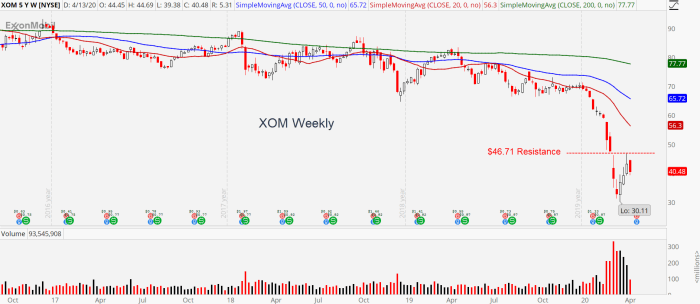

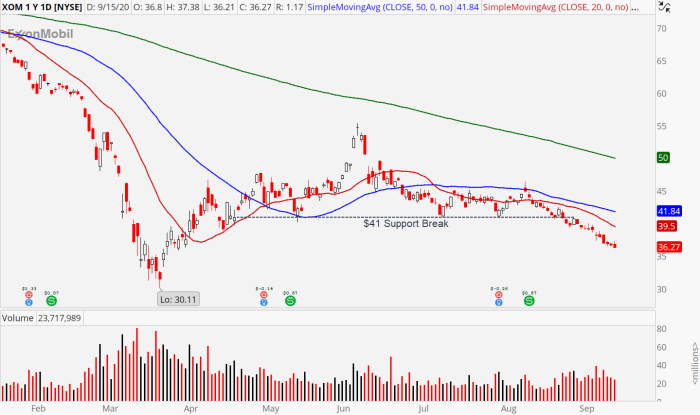

ExxonMobil Stock Price Overview

ExxonMobil’s stock price (XOM) exhibits dynamic behavior reflecting the energy market’s volatility. While precise real-time data requires a live financial feed, we can illustrate a typical day’s performance and recent trends. Assume for the purpose of this example, that on a particular trading day, the stock opened at $105, reached a high of $106.50, experienced a low of $104.25, and closed at $105.75.

The trading volume for that day was approximately 10 million shares. This example demonstrates the typical daily price fluctuations.

| Time Period | Opening Price | Closing Price | % Change |

|---|---|---|---|

| Last Week | $104.00 (Example) | $105.75 (Example) | +1.73% (Example) |

| Last Month | $102.00 (Example) | $105.75 (Example) | +3.67% (Example) |

| Last Year | $90.00 (Example) | $105.75 (Example) | +17.5% (Example) |

Factors Influencing ExxonMobil’s Stock Price

Source: investorplace.com

Several macroeconomic factors significantly influence ExxonMobil’s stock price. These include global oil prices, geopolitical events, and overall economic conditions.

Oil prices directly impact ExxonMobil’s profitability. Higher oil prices generally lead to increased revenue and higher stock prices, while lower prices have the opposite effect. The relationship is not always linear, however, as other factors can also influence the stock price.

Geopolitical instability in oil-producing regions can cause significant price swings, affecting ExxonMobil’s stock. Events like wars, sanctions, or political upheaval can disrupt supply chains and create uncertainty, impacting investor confidence.

Comparing ExxonMobil’s performance to competitors like Chevron (CVX) and BP (BP) reveals relative strengths and weaknesses. Analyzing their respective stock price movements in relation to oil prices and geopolitical events provides a broader perspective on market forces at play.

ExxonMobil’s Financial Performance

Source: marketrealist.com

ExxonMobil’s recent quarterly earnings reports provide insights into the company’s financial health. These reports typically include key metrics such as revenue, net income, and earnings per share (EPS). Analyzing trends in these metrics over time helps assess the company’s financial performance.

| Year | Revenue (Billions USD) | Net Income (Billions USD) | Profit Margin (%) |

|---|---|---|---|

| 2022 (Example) | 390 (Example) | 55 (Example) | 14.1% (Example) |

| 2021 (Example) | 270 (Example) | 23 (Example) | 8.5% (Example) |

| 2020 (Example) | 180 (Example) | -22 (Example) | -12.2% (Example) |

| 2019 (Example) | 260 (Example) | 14 (Example) | 5.4% (Example) |

| 2018 (Example) | 290 (Example) | 20 (Example) | 6.9% (Example) |

Significant changes in ExxonMobil’s financial position, such as large capital expenditures or acquisitions, are typically highlighted in their financial reports and investor presentations. These events can significantly impact the company’s stock price.

ExxonMobil’s Business Strategy and Outlook

ExxonMobil’s business strategy focuses on its core oil and gas operations while making strategic investments in renewable energy sources. The company aims to balance its traditional energy business with a transition towards cleaner energy technologies.

- Expanding oil and gas production in key regions

- Investing in carbon capture and storage technologies

- Developing renewable energy projects, including wind and solar power

- Improving operational efficiency and reducing costs

Potential risks include fluctuating oil prices, increased regulatory scrutiny on emissions, and competition from renewable energy companies. ExxonMobil’s long-term growth prospects depend on its ability to adapt to the changing energy landscape and maintain profitability.

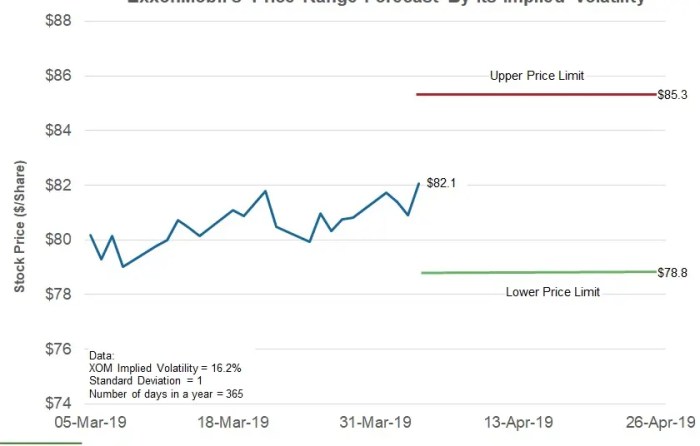

Analyst Ratings and Predictions

Financial analysts provide ratings and price targets for ExxonMobil’s stock, offering insights into their future performance expectations. These predictions vary based on individual analyst models and interpretations of market trends. A consensus view may emerge, but significant divergence in opinions is common.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Analyst Firm A (Example) | Buy (Example) | $115 (Example) | October 26, 2023 (Example) |

| Analyst Firm B (Example) | Hold (Example) | $108 (Example) | October 26, 2023 (Example) |

| Analyst Firm C (Example) | Sell (Example) | $95 (Example) | October 26, 2023 (Example) |

Investor Sentiment and Market Trends

Investor sentiment toward ExxonMobil is influenced by various factors, including oil prices, company performance, and broader market trends. Positive news, such as strong earnings reports or strategic acquisitions, tends to boost investor confidence, while negative news, like environmental controversies or production disruptions, can negatively impact sentiment.

Broader market trends, such as interest rate changes or economic growth forecasts, also affect ExxonMobil’s stock price. For example, rising interest rates may increase borrowing costs for energy companies, potentially impacting profitability and investor sentiment.

Recent news events, such as significant geopolitical events in oil-producing regions or changes in environmental regulations, can influence investor behavior and create short-term price fluctuations.

ExxonMobil’s Dividend Policy, Exxon current stock price

ExxonMobil has a long history of paying dividends to its shareholders, making it attractive to income-seeking investors. The dividend yield represents the annual dividend payment relative to the stock price. The sustainability of ExxonMobil’s dividend payouts depends on the company’s profitability and financial strength.

- 2014: $3.00 per share (Example)

- 2015: $3.00 per share (Example)

- 2016: $3.00 per share (Example)

- 2017: $3.20 per share (Example)

- 2018: $3.48 per share (Example)

- 2019: $3.48 per share (Example)

- 2020: $3.48 per share (Example)

- 2021: $3.48 per share (Example)

- 2022: $3.48 per share (Example)

- 2023: $3.60 per share (Example)

Note: These are example dividend values. Refer to official ExxonMobil reports for accurate data.

Detailed FAQs: Exxon Current Stock Price

What are the major risks associated with investing in ExxonMobil stock?

Major risks include fluctuations in oil prices, geopolitical instability impacting energy markets, increasing regulatory scrutiny of fossil fuel companies, and the transition towards renewable energy sources.

How does ExxonMobil’s dividend compare to its competitors?

A comparison requires examining the dividend yields and payout ratios of ExxonMobil’s major competitors. This information is readily available through financial news websites and investor relations sections of competitor companies.

Where can I find real-time ExxonMobil stock price data?

Real-time data is available on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

What is ExxonMobil’s current debt-to-equity ratio?

This ratio can be found in ExxonMobil’s quarterly and annual financial reports, readily accessible on their investor relations website.