Facebook IPO: A Retrospective Analysis

Source: cheggcdn.com

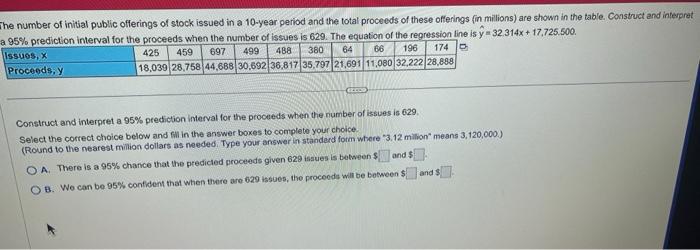

Facebook ipo stock price – Facebook’s initial public offering (IPO) in 2012 was a highly anticipated event, marking a significant milestone for the social media giant and the tech industry as a whole. This analysis examines the pricing and valuation of the IPO, its immediate and long-term stock performance, the influence of major announcements and events, and the evolution of investor sentiment. We will explore the interplay of market conditions, company performance, and external factors in shaping Facebook’s stock price trajectory.

Facebook IPO Pricing and Valuation

Facebook’s IPO price was determined by several factors, including the company’s projected future earnings, its market position as a dominant social media platform, and prevailing market conditions. The IPO was priced at $38 per share, valuing the company at approximately $104 billion. This valuation was significantly higher than many other tech IPOs at the time, reflecting investor confidence in Facebook’s growth potential.

Leading up to the IPO, the market experienced a period of relative stability, although concerns existed regarding the sustainability of the tech bubble. Several prominent investment banks, including Morgan Stanley, JPMorgan Chase, and Goldman Sachs, played crucial roles in underwriting the IPO and managing the offering process. Their roles encompassed pricing the offering, marketing it to investors, and managing the allocation of shares.

| Metric | Pre-IPO | Post-IPO (Immediately) |

|---|---|---|

| Revenue (USD Billion) | 3.7 | 3.7 (approximately, no significant immediate change) |

| Net Income (USD Billion) | 0.67 | 0.67 (approximately, no significant immediate change) |

| Market Cap (USD Billion) | N/A (Private) | 104 |

| Shares Outstanding (Millions) | N/A (Private) | 2700 |

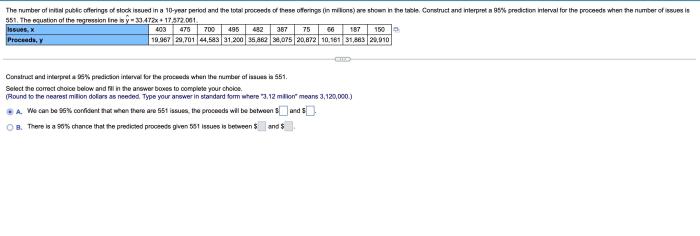

Stock Performance in the Immediate Aftermath of the IPO

Source: cheggcdn.com

The immediate aftermath of Facebook’s IPO was marked by significant volatility. While the initial trading day saw the stock price close slightly above the offering price, subsequent trading sessions witnessed considerable price fluctuations. Several news events and investor sentiment shifts influenced this volatility. Early investor reaction was mixed, with some expressing disappointment over the initial price movement, while others remained optimistic about Facebook’s long-term prospects.

The initial uncertainty and subsequent price drops contributed to negative early investor sentiment. Several analysts had predicted sustained growth post-IPO, but the early performance didn’t immediately reflect these predictions.

The Facebook IPO stock price initially saw significant volatility, a common occurrence for major tech offerings. Understanding market fluctuations requires looking at broader financial trends; for instance, checking the current performance of established financial institutions like the bny mellon stock price today can provide context. Ultimately, both Facebook’s and BNY Mellon’s stock prices reflect the overall health and investor sentiment within the market.

Long-Term Stock Price Trends and Influencing Factors

Source: bisnis.com

Over the long term, Facebook’s stock price has exhibited a generally upward trajectory, punctuated by periods of growth and correction. Key milestones such as the acquisition of Instagram and WhatsApp, significant product launches, and changes in advertising policies have all played a role in shaping the stock price. Compared to its competitors, Facebook’s performance has been relatively strong, though it has faced periods of underperformance relative to the broader market.

Company performance, market trends (like economic downturns), and regulatory changes (like antitrust concerns) have all significantly impacted its stock price.

- 2012: IPO and initial price volatility.

- 2014: Acquisition of WhatsApp, positive impact on stock price.

- 2018: Cambridge Analytica scandal, significant negative impact.

- 2019-2020: Increased regulatory scrutiny, impacting stock price.

- 2021: Renaming to Meta and focus on metaverse, mixed investor reaction.

Impact of Major Announcements and Events on Stock Price

Significant events have demonstrably impacted Facebook’s stock price. The acquisitions of Instagram and WhatsApp, for example, were generally viewed positively by investors, leading to increases in the stock price. Conversely, major advertising policy changes, privacy concerns, and scandals, such as the Cambridge Analytica scandal, led to significant negative impacts. Facebook’s financial reports have consistently shown a strong correlation with subsequent stock price movements; positive reports generally lead to price increases, while negative reports lead to decreases.

A visual representation would show a graph with a generally upward trend, marked by sharp spikes and dips corresponding to major events. For instance, the Cambridge Analytica scandal would be represented by a sharp downward dip, while the Instagram acquisition would be shown as a significant upward spike.

Investor Sentiment and Market Perception of Facebook, Facebook ipo stock price

Investor sentiment towards Facebook has evolved significantly over time. Early optimism surrounding the IPO gave way to periods of uncertainty and even pessimism following the Cambridge Analytica scandal and increasing regulatory scrutiny. However, the company’s consistent revenue growth and expansion into new areas have generally maintained a positive long-term outlook among many investors. Different investor perspectives exist regarding Facebook’s long-term growth potential, with some emphasizing its dominance in social media and others expressing concerns about competition, regulation, and ethical issues.

Media coverage has played a significant role in shaping public and investor perception, often amplifying both positive and negative news events.

The narrative would illustrate a shift from initial excitement and high valuations to a more cautious and nuanced assessment of the company’s future, shaped by major events and evolving ethical considerations. This ultimately impacts investor decisions and the stock’s price.

FAQ Summary: Facebook Ipo Stock Price

What were some of the immediate challenges Facebook faced after its IPO?

Initial technical glitches with the IPO process itself and concerns about Facebook’s long-term mobile monetization strategy contributed to early negative investor sentiment.

How did Facebook’s acquisitions of Instagram and WhatsApp impact its stock price?

These acquisitions were generally viewed positively by investors, strengthening Facebook’s market position and adding significant user bases, leading to overall stock price appreciation.

What role did regulatory scrutiny play in Facebook’s stock price performance?

Increased regulatory scrutiny regarding data privacy and antitrust concerns has led to periods of stock price volatility and uncertainty.

How has Facebook’s advertising revenue affected its stock price?

Facebook’s stock price is highly correlated with its advertising revenue. Strong revenue growth generally leads to positive stock price movements, while declines or slower growth can negatively impact the stock.