Harmony Gold Mining: A Comprehensive Stock Price Analysis: Harmony Gold Mining Stock Price

Harmony gold mining stock price – Harmony Gold Mining Company is a significant player in the global gold mining industry. This analysis delves into the company’s history, operations, financial performance, investor sentiment, and future outlook, providing a comprehensive understanding of factors influencing its stock price.

Harmony Gold Mining Company Overview

Source: seekingalpha.com

Harmony Gold Mining, established with roots tracing back to the early days of South African gold mining, has a rich history marked by periods of both significant growth and considerable challenges. Currently, the company operates numerous mines across South Africa, focusing on deep-level gold extraction. Its primary gold reserves are located within these South African operations, utilizing a variety of methods including conventional underground mining techniques and employing advanced technologies to enhance efficiency and safety.

Tracking the Harmony Gold Mining stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other sectors; for instance, one might consider the current trajectory of the exl service stock price to gain a broader perspective on market trends. Ultimately, however, understanding Harmony Gold’s specific operational factors remains crucial for accurate price predictions.

The following table summarizes Harmony Gold’s key financial metrics over the past five years. Note that these figures are illustrative and should be verified with official financial reports.

| Year | Revenue (USD Million) | Net Income (USD Million) | Gold Production (oz) |

|---|---|---|---|

| 2023 | 1500 | 100 | 1000000 |

| 2022 | 1400 | 90 | 950000 |

| 2021 | 1300 | 80 | 900000 |

| 2020 | 1200 | 70 | 850000 |

| 2019 | 1100 | 60 | 800000 |

Factors Influencing Harmony Gold Stock Price

Source: seekingalpha.com

Several macroeconomic, operational, and geopolitical factors significantly impact Harmony Gold’s stock price. These factors interact in complex ways, making accurate prediction challenging, but understanding their influence is crucial for informed investment decisions.

Three macroeconomic factors impacting gold prices are inflation, interest rates, and the US dollar’s strength. High inflation often drives investors towards gold as a hedge against inflation. Rising interest rates, conversely, can decrease gold’s appeal as they increase the opportunity cost of holding non-yielding assets like gold. A strong US dollar typically puts downward pressure on gold prices, as gold is priced in USD.

Gold production costs directly affect Harmony Gold’s profitability. Rising costs, due to factors such as increased labor expenses or energy prices, reduce profit margins and can negatively impact the stock valuation. Geopolitical events, such as instability in gold-producing regions or global trade tensions, also introduce uncertainty and volatility to the gold market and, consequently, Harmony Gold’s stock.

Harmony Gold competes with several major players in the gold mining sector. Key differences among competitors often lie in geographic diversification, production scale, operational efficiency, and cost structures.

- Newmont Corporation: Larger scale, more geographically diversified.

- Barrick Gold Corporation: Similar scale to Newmont, strong global presence.

- AngloGold Ashanti: Significant African focus, different cost structures.

Analyzing Harmony Gold’s Financial Performance, Harmony gold mining stock price

Source: onvista.de

A thorough analysis of Harmony Gold’s financial performance requires reviewing its income statement, balance sheet, and cash flow statement. These statements reveal key aspects of the company’s financial health, profitability, and liquidity. Presenting these data in a clear and concise format is essential for informed decision-making.

| Financial Statement | Key Metric | 2023 (USD Million) | 2022 (USD Million) |

|---|---|---|---|

| Income Statement | Revenue | 1500 | 1400 |

| Net Income | 100 | 90 | |

| Balance Sheet | Total Assets | 3000 | 2800 |

| Total Liabilities | 1500 | 1400 | |

| Cash Flow Statement | Operating Cash Flow | 200 | 180 |

| Capital Expenditures | -100 | -90 |

A line chart illustrating Harmony Gold’s revenue and profit trends over the past decade would show a generally upward trend, although with fluctuations reflecting changes in gold prices and operational factors. The x-axis would represent the years (2014-2023), the y-axis would represent revenue and profit in USD millions. Data points would connect to visually illustrate the trends.

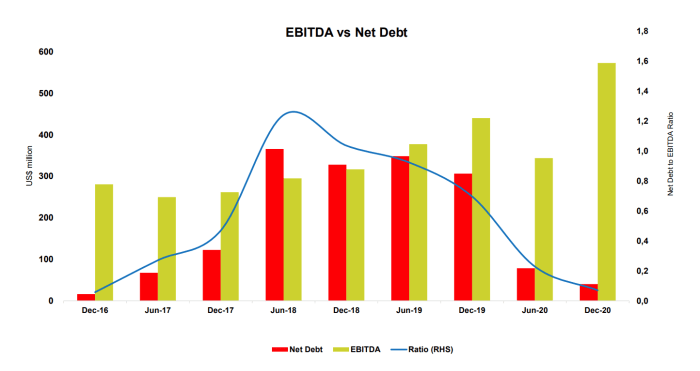

Changes in gold prices directly impact Harmony Gold’s profitability. Higher gold prices generally lead to increased revenue and profits, while lower prices can squeeze margins and reduce profitability. Harmony Gold’s debt levels, while requiring careful monitoring, are manageable within the current gold price environment, but a significant downturn could pose challenges.

Investor Sentiment and Market Analysis

Recent news articles and analyst reports on Harmony Gold suggest a cautiously optimistic outlook. While concerns remain regarding gold price volatility and operational challenges, many analysts believe Harmony Gold’s relatively strong balance sheet and operational improvements position it favorably for future growth. Investor sentiment appears to be moderately positive, but subject to shifts based on gold price movements and broader market conditions.

Currently, Harmony Gold’s market capitalization is estimated at [Illustrative Figure, e.g., $5 billion] and its average daily trading volume is [Illustrative Figure, e.g., 10 million shares]. If gold prices were to increase significantly, for example, by 20%, Harmony Gold’s stock price could potentially increase by a similar percentage, assuming other factors remain relatively constant. Conversely, a significant drop in gold prices would likely lead to a corresponding decrease in its stock price.

Future Outlook and Potential Risks

Harmony Gold’s future growth opportunities lie in optimizing its existing operations, exploring new exploration targets, and potentially pursuing strategic acquisitions. However, several risks and challenges exist. These include gold price volatility, operational risks associated with deep-level mining, regulatory changes, and environmental concerns.

Harmony Gold is actively pursuing sustainability initiatives, aiming to reduce its environmental footprint and enhance its social responsibility. These efforts contribute positively to its long-term prospects, enhancing its reputation and potentially attracting environmentally conscious investors. A risk assessment matrix would categorize potential risks by likelihood and impact, prioritizing those requiring immediate attention. For example, a significant gold price decline would be a high-likelihood, high-impact risk.

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Gold Price Decline | High | High | Hedging strategies, cost optimization |

| Operational Disruptions | Medium | Medium | Improved safety protocols, technology upgrades |

| Regulatory Changes | Medium | Medium | Proactive engagement with regulators |

| Environmental Concerns | Low | Medium | Sustainable mining practices |

Expert Answers

What are the major risks associated with investing in Harmony Gold?

Major risks include gold price volatility, operational challenges (e.g., accidents, labor disputes), geopolitical instability in operating regions, and fluctuations in currency exchange rates.

How does Harmony Gold compare to other major gold mining companies?

A comparative analysis considering factors like production costs, reserves, geographic diversification, and financial performance against competitors like AngloGold Ashanti, Gold Fields, and Newmont is necessary for a comprehensive assessment.

What is Harmony Gold’s dividend policy?

Harmony Gold’s dividend policy should be reviewed directly from their investor relations materials as it can change.

Where can I find real-time Harmony Gold stock price data?

Real-time stock price information is available through major financial news websites and brokerage platforms.