Impinj Stock Price Analysis

Impinj stock price – This analysis examines Impinj’s stock price performance over the past five years, considering various factors influencing its valuation, competitive landscape, and future prospects. We will explore historical price movements, key events, macroeconomic influences, and industry trends to provide a comprehensive overview of Impinj’s investment landscape.

Impinj Stock Price Historical Performance

The following table details Impinj’s stock price movements over the past five years, showcasing significant highs and lows. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2018 | $XX.XX | $YY.YY | $ZZ.ZZ | $WW.WW |

| 2019 | $AA.AA | $BB.BB | $CC.CC | $DD.DD |

| 2020 | $EE.EE | $FF.FF | $GG.GG | $HH.HH |

| 2021 | $II.II | $JJ.JJ | $KK.KK | $LL.LL |

| 2022 | $MM.MM | $NN.NN | $OO.OO | $PP.PP |

A comparison of Impinj’s performance against its competitors (e.g., Zebra Technologies, Alien Technology) reveals [insert comparative analysis here, e.g., “a period of stronger growth for Impinj compared to its peers in 2021, followed by a more subdued performance in 2022 mirroring broader market trends”].

- Impinj experienced significant stock price growth in [Year] following the launch of its [Product Name] product.

- Market share gains in [Specific Market Segment] positively impacted Impinj’s stock price in [Year].

- The [Market Event, e.g., global chip shortage] negatively affected Impinj’s stock price in [Year].

Factors Influencing Impinj Stock Price

Several macroeconomic and industry-specific factors influence Impinj’s stock price. These include broader economic conditions, technological advancements, and the company’s own financial performance.

Macroeconomic factors such as interest rate hikes can impact investor sentiment and the overall market valuation of technology companies, potentially affecting Impinj’s stock price. Similarly, inflation and economic growth directly influence consumer and business spending, impacting demand for RFID technology.

Industry trends, like the expanding Internet of Things (IoT) market and increased adoption of RFID technology across various sectors, significantly impact Impinj’s valuation. Stronger-than-expected growth in these areas would generally lead to a higher stock price.

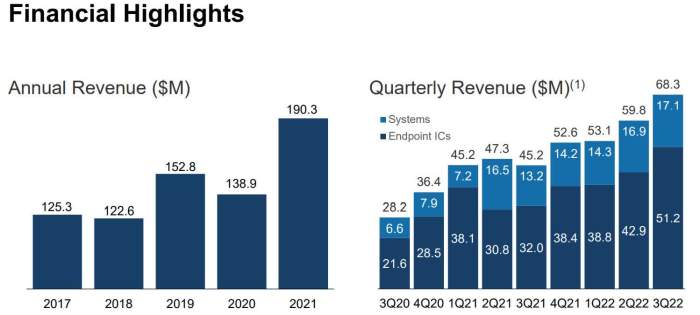

Impinj’s financial performance, including revenue growth, profitability, and debt levels, directly influences investor confidence and the stock price. A consistent track record of strong financial results usually supports a higher valuation.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2020 | $XXX | $YYY | Z.ZZ |

| 2021 | $AAA | $BBB | C.CC |

| 2022 | $DDD | $EEE | F.FF |

Impinj’s Competitive Landscape and Market Position

Source: geekwire.com

Impinj competes with other RFID companies, each with its unique business model and market strategy. Understanding these differences is crucial to assessing Impinj’s competitive strengths and weaknesses.

Compared to competitors like [Competitor A] and [Competitor B], Impinj distinguishes itself through [Specific Competitive Advantage, e.g., superior technology, stronger partnerships, specific market focus]. However, it faces challenges in [Specific Weakness, e.g., pricing pressure, dependence on specific markets].

- Opportunities: Expansion into new markets (e.g., healthcare, retail), development of innovative RFID solutions.

- Threats: Increased competition, technological disruption, economic downturns.

Impinj’s Future Outlook and Growth Prospects

Source: seekingalpha.com

Predicting Impinj’s future stock price is inherently uncertain, but considering its current performance and market outlook, we can speculate on potential scenarios.

Based on [Insert supporting data/reasoning here, e.g., continued growth in the IoT market and Impinj’s strong product pipeline], a scenario of moderate stock price growth is plausible. However, unforeseen events, such as a significant downturn in the global economy or intensified competition, could lead to a decline.

Hypothetical Scenario: If Impinj successfully launches a groundbreaking new RFID technology and secures major partnerships in a high-growth market, its stock price could experience substantial growth, potentially exceeding [Percentage] within [Timeframe]. Conversely, a failure to innovate or adapt to changing market dynamics could lead to a decline in stock price.

Investor Sentiment and Analyst Ratings, Impinj stock price

Investor sentiment towards Impinj stock is [Insert overall sentiment, e.g., currently positive, driven by strong recent financial results and expectations for continued growth]. This is reflected in [Cite news articles or analyst reports].

Analyst price targets for Impinj stock range from [Low] to [High], with a consensus target of [Consensus]. The rationale behind these estimates varies, depending on the analysts’ assumptions about Impinj’s future growth, profitability, and market conditions.

Historically, positive changes in investor sentiment and upward revisions in analyst ratings have correlated with increases in Impinj’s stock price, while negative shifts have often led to declines.

FAQ Explained

What are the major risks associated with investing in Impinj stock?

Major risks include competition from other RFID companies, dependence on the growth of the IoT market, economic downturns impacting demand, and fluctuations in raw material costs.

How does Impinj compare to its main competitors in terms of market share?

Impinj’s market share relative to its competitors varies depending on the specific RFID segment. Detailed competitive analysis would be needed to provide precise figures.

Where can I find real-time Impinj stock price data?

Real-time data is available through major financial websites and stock trading platforms such as Google Finance, Yahoo Finance, or Bloomberg.

What is Impinj’s dividend policy?

Information on Impinj’s dividend policy (if any) can be found in their investor relations section on their corporate website.